American Airlines 1998 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

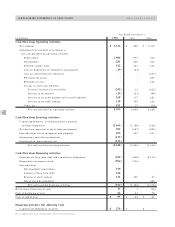

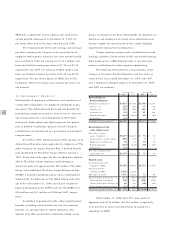

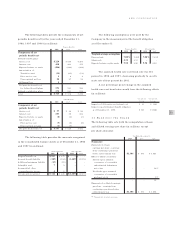

2.INVESTMENTS

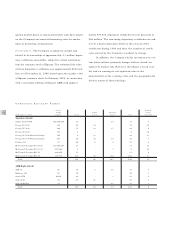

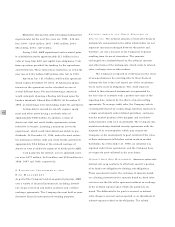

Short-term investments consisted of (in millions):

December 31,

1998 1997

Overnight investments and time deposits $133 $322

Corporate notes 950 921

Asset backed securities 498 428

U. S. Government agency mortgages 169 305

Other 228 394

$1,978 $2,370

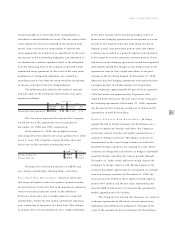

Short-term investments at December 31, 1998, by

contractual maturity included (in millions):

Due in one year or less $494

Due after one year through three years 1,470

Due after three years 14

$1,978

All short-term investments are classified as available-

for-sale and stated at fair value. Net unrealized gains and

losses, net of deferred taxes, are reflected as an adjustment

to stockholders’ equity.

At December 31, 1998, the Company owned approx-

imately 3.1 million depository certificates convertible,

subject to certain restrictions, into the common stock of

Equant N.V. (Equant), which completed an initial public

offering in July 1998. As of December 31, 1998, the esti-

mated fair value of these depository certificates was

approximately $210 million, based upon the publicly-

traded market value of Equant common stock. The

estimated fair value of the certificates was not readily deter-

minable as of December 31, 1997. The carrying value (cost

basis) of the Company’s investment in the depository certifi-

cates as of December 31, 1998 and 1997 was de minimis.

In connection with a secondary offering of Equant,

the Company sold approximately 900,000 depository cer-

tificates in February 1999 for net proceeds of $66 million.

The remaining depository certificates are subject to a final

reallocation between the owners of the certificates during

1999 and thus, the number of certificates owned by the

Company is subject to change.

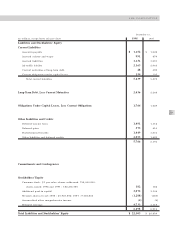

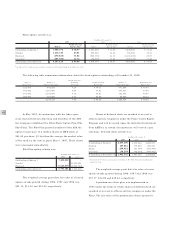

3.COMMITMENTS AND CONTINGENCIES

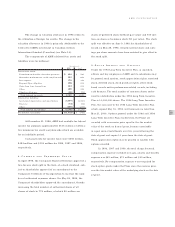

At December 31, 1998, the Company had commitments to

acquire the following aircraft: 100 Boeing 737-800s, 34

Boeing 777-200IGWs, six Boeing 757-200s, four Boeing 767-

300ERs, 75 Embraer EMB-135s, 30 Embraer EMB-145s and

25 Bombardier CRJ-700s. Deliveries of these aircraft com-

mence in 1999 and will continue through 2005. Future

payments, including estimated amounts for price escalation

through anticipated delivery dates for these aircraft and related

equipment, will approximate $2.7 billion in 1999, $2.0 billion

in 2000, $1.6 billion in 2001 and an aggregate of approxi-

mately $1.5 billion in 2002 through 2005. In addition to

these commitments for aircraft, the Company’s Board of

Directors has authorized expenditures of approximately $2.1

billion over the next five years related to modifications to air-

craft, renovations of -- and additions to -- airport and office

facilities, and the acquisition of various other equipment and

assets. AMR expects to spend approximately $625 million of

this authorized amount in 1999.

The Miami International Airport Authority is currently

remediating various environmental conditions at the Miami

International Airport (the Airport) and funding the remedia-

tion costs through landing fee revenues. Future costs of the

remediation effort may be borne by carriers operating at the

Airport, including American, through increased landing fees

and/or other charges since certain of the potentially responsi-

ble parties are no longer in business. The future increase in

landing fees and/or other charges may be material but cannot

be reasonably estimated due to various factors, including the

unknown extent of the remedial actions that may be required,

the proportion of the cost that will ultimately be recovered

from the responsible parties, and uncertainties regarding the

environmental agencies that will ultimately supervise the

remedial activities and the nature of that supervision.

In April 1995, American announced an agreement to

sell 12 of its McDonnell Douglas MD-11 aircraft to Federal

Express Corporation (FedEx). In addition, in March 1998, the

Company exercised its option to sell its remaining seven MD-

11 aircraft to FedEx. No significant gain or loss is expected to

be recognized as a result of these transactions. Eight aircraft

had been delivered as of December 31, 1998. The remaining