American Airlines 1998 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

are offset by changes in the value of the yen-denominated

lease obligations translated at the current exchange rate.

Discounts or premiums are accreted or amortized as an

adjustment to interest expense over the lives of the underly-

ing lease obligations. The related amounts due to or from

counterparties are included in other liabilities or other

assets. The net fair values of the Company’s currency

exchange agreements, representing the amount the

Company would pay to terminate the agreements, were

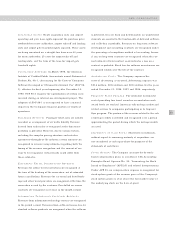

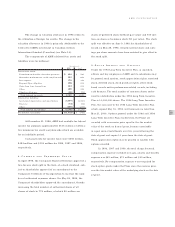

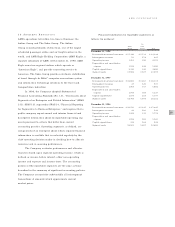

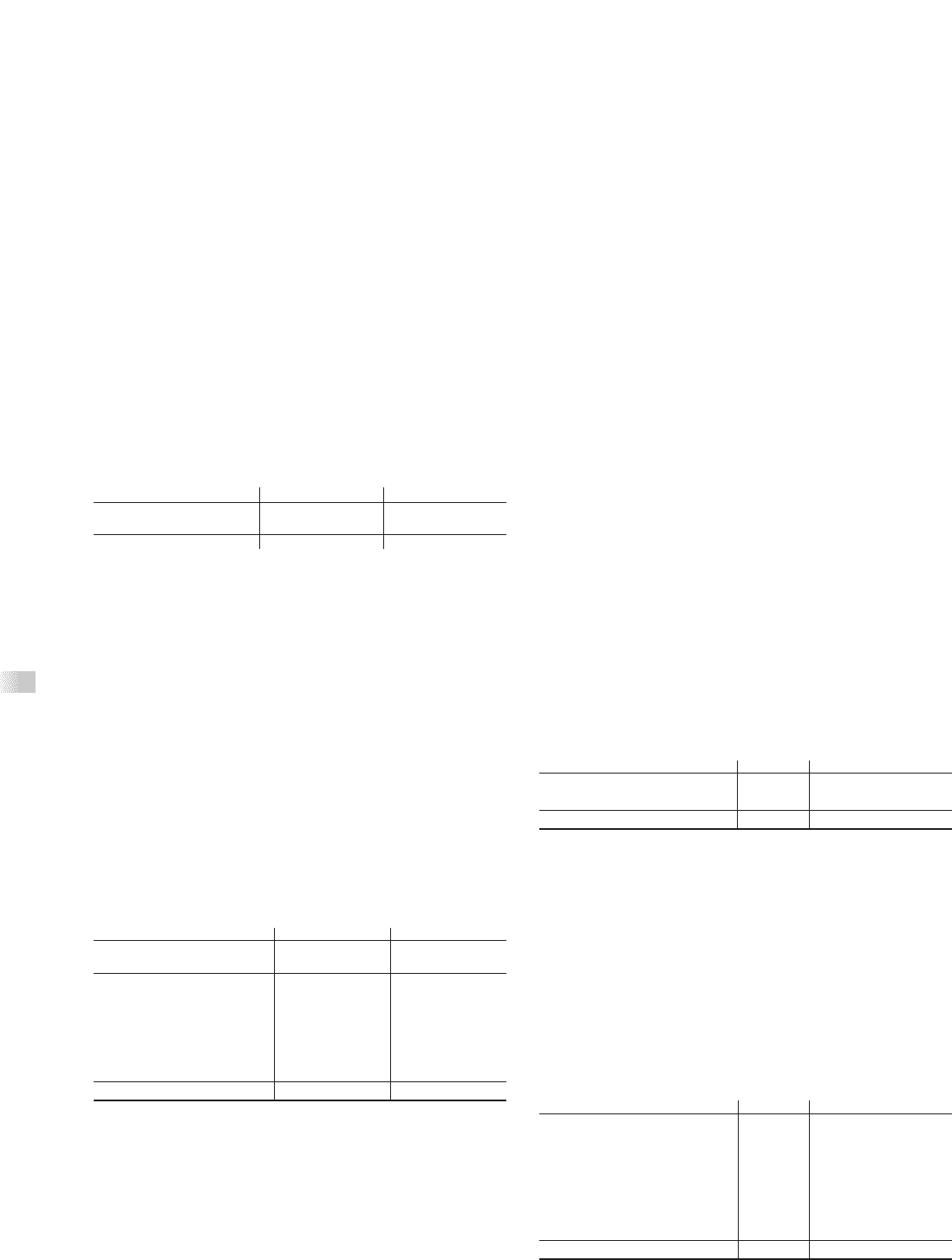

(in millions):

December 31,

1998 1997

Notional Notional

Amount

(

Fair Value

)

Amount Fair Value

Japanese yen

33.7 billion

$(5)

24.5 billion

$(15)

The exchange rates on the Japanese yen agreements

range from 66.50 to 118.35 yen per U.S. dollar.

FAIR VALUES OF FINANCIAL INSTRUMENTS The fair val-

ues of the Company’s long-term debt were estimated using

quoted market prices where available. For long-term debt

not actively traded, fair values were estimated using dis-

counted cash flow analyses, based on the Company’s

current incremental borrowing rates for similar types of bor-

rowing arrangements. The carrying amounts and estimated

fair values of the Company’s long-term debt, including cur-

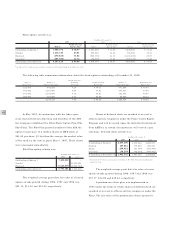

rent maturities, were (in millions):

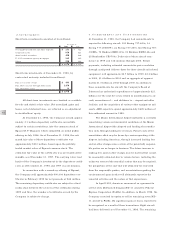

December 31,

1998 1997

Carrying Fair Carrying Fair

Val u e Value Value Value

8.05% - 10.62% notes $875 $973 $ 1,249 $ 1,372

Secured debt 890 1,013 660 766

9.0% - 10.20% debentures 437 531 437 540

6.0% - 7.10% bonds 176 189 176 194

Variable rate indebtedness 86 86 86 86

Other 20 20 35 36

$2,484 $2,812 $ 2,643 $ 2,994

All other financial instruments, except for the invest-

ment in Equant, are either carried at fair value or their

carrying value approximates fair value.

In June 1998, the Financial Accounting Standards

Board issued Statement of Financial Accounting Standards

No. 133, “Accounting for Derivative Instruments and

Hedging Activities” (SFAS 133), which is required to be

adopted in years beginning after June 15, 1999. SFAS 133

permits early adoption as of the beginning of any fiscal

quarter after its issuance. SFAS 133 will require the

Company to recognize all derivatives on the balance sheet at

fair value. Derivatives that are not hedges must be adjusted

to fair value through income. If the derivative is a hedge,

depending on the nature of the hedge, changes in the fair

value of derivatives will either be offset against the change

in fair value of the hedged assets, liabilities, or firm commit-

ments through earnings or recognized in other

comprehensive income until the hedged item is recognized

in earnings. The ineffective portion of a derivative’s change

in fair value will be immediately recognized in earnings.

The Company is currently evaluating the impact of SFAS

133 to the Company’s financial condition or results of

operations.

7.INCOME TAXES

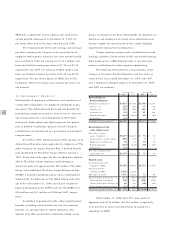

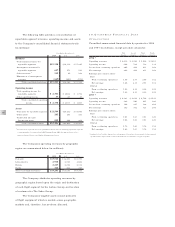

The significant components of the income tax provision

were (in millions):

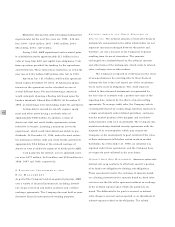

Year Ended December 31,

1998 1997 1996

Current $546 $288 $ 296

Deferred 312 363 217

$858 $651 $ 513

The income tax provision includes a federal income

tax provision of $741 million, $566 million and $452 mil-

lion and a state income tax provision of $93 million, $71

million and $53 million for the years ended December 31,

1998, 1997 and 1996, respectively.

The income tax provision differed from amounts

computed at the statutory federal income tax rate as follows

(in millions):

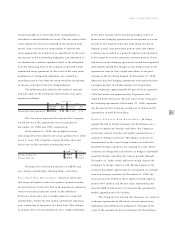

Year Ended December 31,

1998 1997 1996

Statutory income tax provision $757 $568 $ 559

State income tax provision, net 60 46 35

Meal expense 19 21 18

Minority interest 14 12 1

Gain on sale of stock by subsidiary -- (174)

Change in valuation allowance (4) - 67

Other, net 12 4 7

Income tax provision $858 $651 $ 513