American Airlines 1998 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

AMR Corporation (AMR or the Company) was incor-

porated in October 1982. AMR’s principal subsidiary,

American Airlines, Inc. (American), was founded in 1934.

Following the announcement of AMR’s plans to sell the

companies that comprised the majority of what was previ-

ously the Management Services Group, AMR’s operations

fall within two major lines of business: the Airline Group

and The Sabre Group. Additional segment information is

included in Note 15 to the consolidated financial state-

ments.

RESULTS OF OPERATIONS

AMR’s net earnings in 1998 were $1.3 billion, or $7.78

per common share ($7.52 diluted). These results represent

the strongest net earnings ever reported by AMR for a fis-

cal year. AMR’s net earnings in 1997 were $985 million, or

$5.52 per common share ($5.39 diluted). The Company’s

1997 results were adversely affected by (i) a brief strike

and the strike threat from members of the Allied Pilots

Association (APA) during the first quarter of 1997, which

negatively impacted the Company’s net earnings by an

estimated $70 million, and (ii) the reinstatement of the

airline transportation tax in March of 1997.

The following sections provide a discussion of AMR’s

results by reporting segment. The gain on the sale of stock

by a subsidiary of $497 million in 1996 and minority inter-

est expense of $40 million, $36 million and $2 million in

1998, 1997 and 1996, respectively, have not been allocated

to a reporting segment. Additional segment information is

included in Note 15 to the consolidated financial statements.

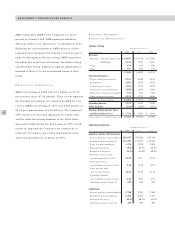

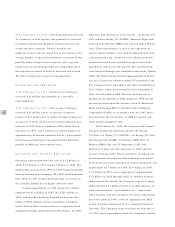

BUSINESS SEGMENT

FINANCIAL HIGHLIGHTS

Airline Group

Year Ended December 31,

(dollars in millions) 1998 1997 1996

Revenues

Passenger - American Airlines, Inc.

$14,695 $14,310 $ 13,645

- AMR Eagle 1,121 1,017 1,047

Cargo 656 687 682

Other 977 889 837

17,449 16,903 16,211

Operating Expenses

Wages, salaries and benefits 5,763 5,480 5,191

Aircraft fuel 1,604 1,923 1,936

Commissions to agents 1,226 1,278 1,252

Depreciation and amortization 1,038 1,038 1,018

Maintenance, materials and repairs

934 861 686

Other operating expenses 4,933 4,754 4,686

Total operating expenses 15,498 15,334 14,769

Operating Income 1,951 1,569 1,442

Other Expense (160) (266) (428)

Earnings Before Income Taxes

and Extraordinary Loss $ 1,791 $1,303 $ 1,014

Average number of equivalent employees

92,000 90,600 88,900

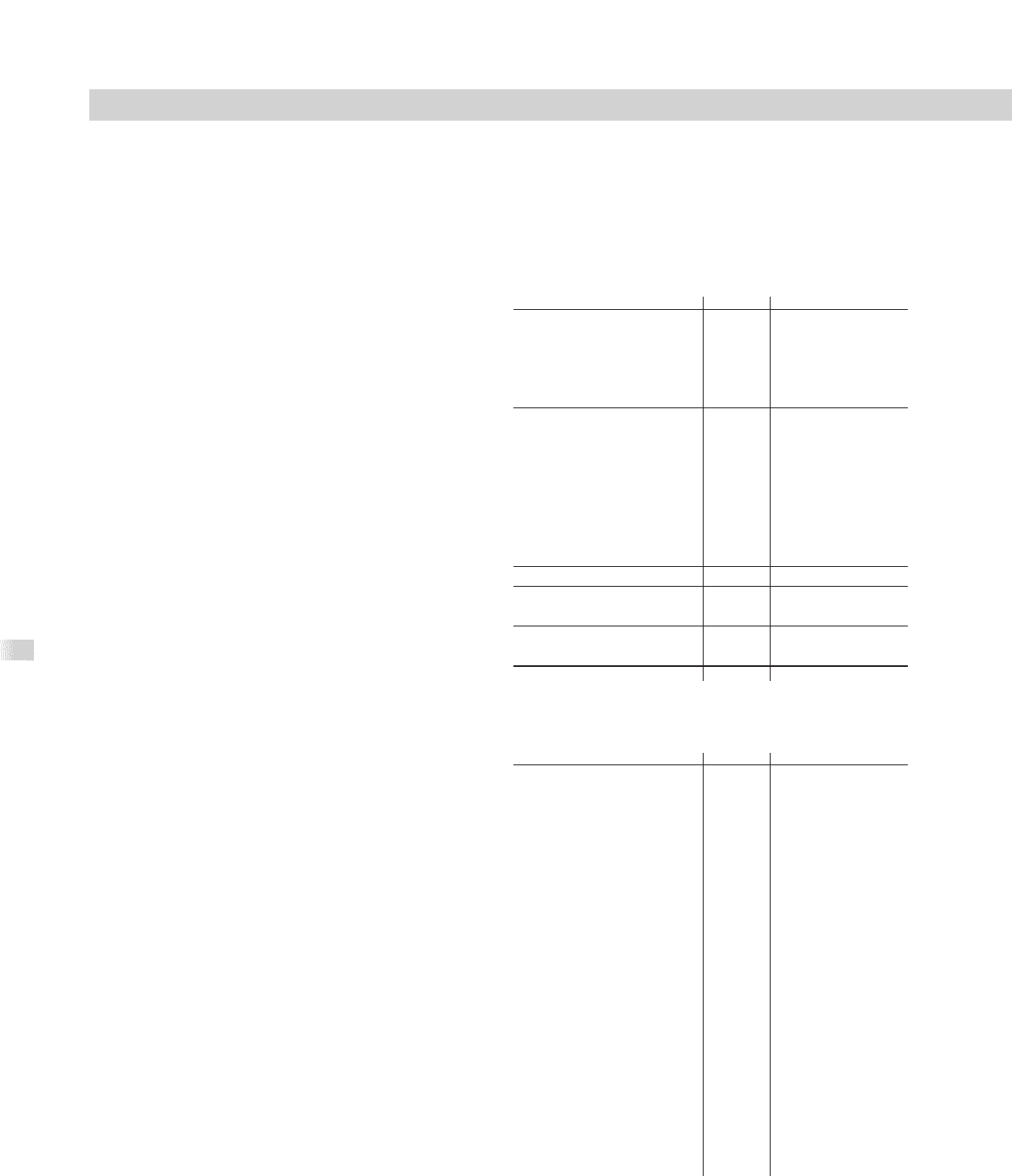

Operating Statistics

Year Ended December 31,

1998 1997 1996

American Airlines Jet Operations

Revenue passenger miles (millions)

108,955 107,026 104,710

Available seat miles (millions) 155,297 153,917 152,886

Cargo ton miles (millions) 1,974 2,032 2,028

Passenger load factor 70.2

%

69.5

%

68.5

%

Breakeven load factor 59.9

%

61.0

%

60.2

%

Passenger revenue yield

per passenger mile (cents) 13.49 13.37 13.03

Passenger revenue

per available seat mile (cents) 9.46 9.30 8.92

Cargo revenue yield

per ton mile (cents) 32.85 33.78 33.14

Operating expenses

per available seat mile (cents) 9.25 9.27 8.91

Operating aircraft at year-end 648 641 642

AMR Eagle

Revenue passenger miles (millions)

2,788 2,553 2,590

Available seat miles (millions) 4,471 4,218 4,431

Passenger load factor 62.4

%

60.5

%

58.5

%

Operating aircraft at year-end 209 199 205

M ANAGEM ENT’ S DISCUSSION AND ANALYSIS