American Airlines 1998 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

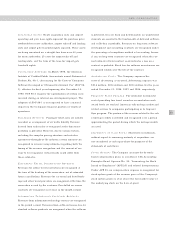

1.SUMMARY OF ACCOUNTING POLICIES

BASIS OF PRESENTATION The consolidated financial state-

ments include the accounts of AMR Corporation (AMR or

the Company), its wholly-owned subsidiaries, including its

principal subsidiary American Airlines, Inc. (American), and

its majority-owned subsidiaries, including The Sabre Group

Holdings, Inc. (The Sabre Group). All significant intercom-

pany transactions have been eliminated. The results of

operations for AMR Services, AMR Combs and TeleService

Resources have been reflected in the consolidated state-

ments of operations as discontinued operations. All share

and per share amounts have been restated to give effect to

the stock split on June 9, 1998, where appropriate. Certain

amounts from prior years have been reclassified to conform

with the 1998 presentation.

USE OF ESTIMATES The preparation of financial state-

ments in conformity with generally accepted accounting

principles requires management to make estimates and

assumptions that affect the amounts reported in the consoli-

dated financial statements and accompanying notes. Actual

results could differ from those estimates.

INVENTORIES Spare parts, materials and supplies relating

to flight equipment are carried at average acquisition cost

and are expensed when incurred in operations. Allowances

for obsolescence are provided, over the estimated useful life

of the related aircraft and engines, for spare parts expected

to be on hand at the date aircraft are retired from service,

plus allowances for spare parts currently identified as

excess. These allowances are based on management esti-

mates, which are subject to change.

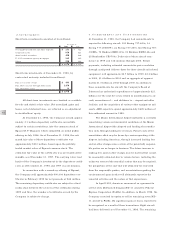

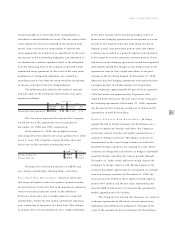

EQUIPMENT AND PROPERTY The provision for deprecia-

tion of operating equipment and property is computed on

the straight-line method applied to each unit of property,

except that major rotable parts, avionics and assemblies are

depreciated on a group basis. The depreciable lives and

residual values used for the principal depreciable asset

classifications are:

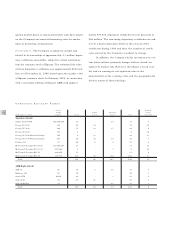

Depreciable Life Residual Value

Boeing 727-200 (Stage II) December 31, 19991None

Boeing 727-200 (to be

converted to Stage III) December 31, 20031None

DC-10 December 31, 20021None

Other American jet aircraft 20 years 5%

Regional jet aircraft 16 years (2)

Other regional aircraft

and engines 17 years 10%

Major rotable parts, avionics Life of equipment 0-10%

and assemblies to which applicable

Improvements to leased flight

equipment Term of lease None

Buildings and improvements 10-30 years or term

(principally on leased land) of lease None

Furniture, fixtures

and other equipment 3-20 years None

Capitalized software 3-10 years None

1Approximate common retirement date.

2Depreciated to guaranteed residual value.

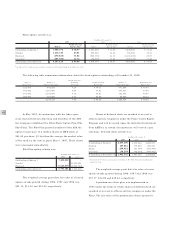

Effective January 1, 1999, in order to more accu-

rately reflect the expected useful life of its aircraft, the

Company changed its estimate of the depreciable lives of

certain American aircraft types from 20 to 25 years and

increased the residual value from five to 10 percent.

In addition, the Company will depreciate its new Boeing

737-800s and Boeing 777-200IGWs over a period of 25

and 30 years, respectively, with a 10 percent residual value.

Equipment and property under capital leases are

amortized over the term of the leases or, in the case of

certain aircraft, over their expected useful lives, and such

amortization is included in depreciation and amortization.

Lease terms vary but are generally 10 to 25 years for

aircraft and seven to 40 years for other leased equipment

and property.

MAINTENANCE AND REPAIR COSTS Maintenance and

repair costs for owned and leased flight equipment are

charged to operating expense as incurred, except engine

overhaul costs incurred by AMR Eagle, which are accrued

on the basis of hours flown.

NOTES TO CONSOLIDATED FINANCIAL STATEM ENTS