American Airlines 1998 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

much more quickly than we could in years past. To illustrate, even with the retirements previously

mentioned, 11 percent of American’s 1999 capacity will be in DC10s and 727s, and should demand slow,

some of those aircraft could be retired earlier than originally planned. AMR is making the investments

necessary to responsibly and profitably grow both its airline and non-airline businesses in order to create

and enhance shareholder value.

Another way the company has enhanced

value for shareholders in recent months has been

by shoring up its capital structure. Following the

completion of American’s pilot contract in 1997,

the company repurchased 11.5 million shares of

AMR common stock to offset any dilution resulting

from the options included in that agreement. This

was followed by the repurchase of an additional

$500 million worth of AMR common stock

between July 1997 and June 1998. In July 1998,

the company launched an additional $500 million repurchase plan, which was completed in early

September, and a month later initiated a third $500 million stock repurchase, completing roughly $100

million of it by year-end.

Also, in June, AMR’s stock split two-for-one, bringing the price of AMR more in line with other airline

stocks and stocks in general, making it easier for small investors to participate in the company’s success

while broadening our shareholder base and increasing our stock’s liquidity.

Much of the company’s strong cash flow in recent years has been devoted to the strengthening of

AMR’s balance sheet. Since 1995, the company has paid off more than $5 billion in debt and lease

obligations. AMR’s debt to total capitalization ratio — which as recently as 1995 was at 83 percent — was,

at the end of 1998, down to 61 percent. And at year-end 1998, AMR had cash and short-term investments

of $2.1 billion.

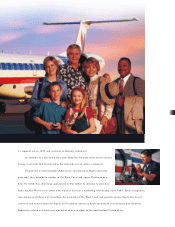

Share repurchases, stock splits and debt reductions are some of the ways we have sought to deliver

value to our shareholders. But the most important thing we can do to create and protect shareholder value

is to do an outstanding job serving our customers. The following essay describes some of our 1998 efforts

to do just that.

11