Seagate 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

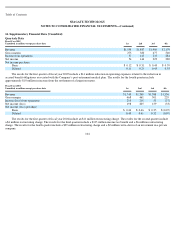

and Microsoft subcontractors, including Flextronics. With respect to such sales, at July 1, 2005 and July 2, 2004, the Company had accounts

receivable of $37 million and $26 million, respectively and accounts payable of $8 million and $7 million, respectively. The Company made

payments for freight services to United Parcel Service of $115 million, $114 million and $120 million in fiscal years 2005, 2004 and 2003,

respectively. At July 1, 2005 and July 2, 2004, the Company had accounts payable to United Parcel Service of $18 million and $10 million,

respectively.

Another member of our board of directors was also a director of E2open, Inc. through August 10, 2004. The Company made payments

totaling $2 million from E2open for the period from July 3, 2004 to August 10, 2004 and $2 million and $1 million for fiscal years 2004 and

2003, respectively. At both July 1, 2005 and July 2, 2004, the Company had no outstanding accounts payable to E2open, Inc. In addition, the

Company increased its strategic investment in E2open, Inc. by $7 million in fiscal year 2005.

A former member of our board of directors who became Chairman and Chief Executive Officer of Motorola, Inc. on January 5, 2004,

resigned from the Company’s board of directors on October 28, 2004. The Company recorded revenue of $16 million from sales to Motorola,

Inc. for the period from January 5, 2004 to July 2, 2004 and $26 million for the period from July 3, 2004 to October 28, 2004. The Company

had accounts receivable of $4 million from Motorola at July 2, 2004.

Another individual who has been a member of our board of directors since April 29, 2004 is also a director of LSI Logic Corp. The

Company recorded revenue of $36 million and $3 million from sales to LSI Logic for fiscal year 2005 and the period from April 29, 2004 to

July 2, 2004, respectively. The Company had accounts receivable of $3 million and $5 million from LSI Logic at July 1, 2005 and July 2, 2004,

respectively. The Company also made payments to LSI Logic of $148 million and $18 million in fiscal years 2005 and 2004, respectively,

related to purchases of various components. At July 1, 2005 and July 2, 2004, the Company had accounts payable to LSI Logic of $46 million

and $17 million, respectively.

Another member of our board of directors became a director of Lenovo Group Limited on May 17, 2005. The Company recorded revenue

of $29 million from sales to Lenovo Group Limited and its subcontractors for the period from May 17, 2005 to July 1, 2005. At July 1, 2005,

the Company had accounts receivable of $33 million from Lenovo Group Limited and its subcontractors.

Executive Officer Receivables

At July 1, 2005, amounts receivable from one executive officer totaled $0.3 million. This loan was made during fiscal year 2001 and

bears interest at 8% per year and is due in lump sum payments, including unpaid interest, in fiscal year 2006. Under the terms of this loan,

certain principal amounts and all accrued and unpaid interest will be forgiven if this executive officer remains employed for a specified period

of time. In the periods in which this executive officer fulfills his employment obligations, the amount of principal and interest, which is

forgiven ratably over his required employment term, is charged to compensation expense. At July 2, 2004, amounts receivable from two

officers totaled $0.7 million.

Dividends to New SAC

During fiscal year 2005, pursuant to its quarterly dividend policy, the Company paid dividends to its shareholders aggregating

approximately $122 million, or $0.26 per share. Of the $122 million paid, New SAC received approximately $60 million. New SAC in turn

distributed the $60 million it received to its ordinary shareholders, including approximately $10 million paid to officers and employees of the

Company who held ordinary shares of New SAC.

94