Seagate 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On July 19, 2005, we declared a dividend of $0.08 per share to be paid on or before August 19, 2005 to our shareholders of record as of

August 5, 2005.

To the extent that the amount of any distribution exceeds our current or accumulated earnings and profits for U.S. federal income tax

purposes in any taxable year, the distribution will be treated as a return of capital for U.S. tax purposes, causing a reduction in a shareholder’s

adjusted tax basis in the common shares. Because we did not have any current or accumulated earnings and profits for U.S. federal income tax

purposes for our taxable year ended July 1, 2005, distributions on our common shares during this period were treated as a return of capital

rather than dividend income for U.S. federal income tax purposes. There can be no assurance, however, that we will not have current or

accumulated earnings and profits for U.S. federal income tax purposes in future years. To the extent that we have current or accumulated

earnings and profits for U.S. federal income tax purposes, distributions on our common shares will not be treated as a return of capital

distribution and will be treated as dividend income, taxable to U.S. shareholders. If during fiscal year 2006, we engage in activities such as the

repayment of our term loan, the repurchase of our common shares, etc., which require significant usage of cash beyond the normal quarterly

distributions to shareholders, it is likely that we would generate current earnings and profits. If this occurs, all distributions made during fiscal

year 2006 are anticipated to be treated as dividend income, even if the activities occur after the distributions are made.

Furthermore, we believe that we were a foreign personal holding company for U.S. federal income tax purposes for our taxable years

ended July 1, 2005 and July 2, 2004. Pursuant to the American Jobs Creation Act of 2004, foreign corporations will be excluded from the

application of the personal holding company rules of the Internal Revenue Code of 1986, as amended (the “Code”), effective for taxable years

of foreign corporations beginning after December 31, 2004. For the Company, the effective date is its fiscal year beginning July 2, 2005. As a

result, if taxable distributions on our common shares are made after July 1, 2005, U.S. shareholders who are individuals may be eligible for

reduced rates of taxation applicable to certain dividend income (currently a maximum rate of 15%) on distributions made after the effective

date.

19

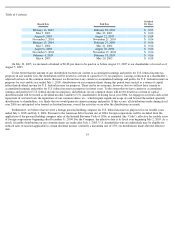

Record Date

Paid Date

Dividend

Per Share

February 14, 2003

February 28, 2003

$

0.03

May 9, 2003

May 23, 2003

$

0.03

August 8, 2003

August 22, 2003

$

0.04

November 7, 2003

November 21, 2003

$

0.04

February 13, 2004

February 27, 2004

$

0.06

May 7, 2004

May 21, 2004

$

0.06

August 6, 2004

August 20, 2004

$

0.06

November 5, 2004

November 19, 2004

$

0.06

February 4, 2005

February 18, 2005

$

0.06

May 6, 2005

May 20, 2005

$

0.08