Seagate 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

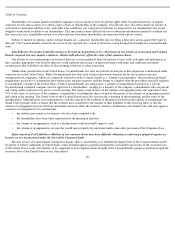

Table of Contents

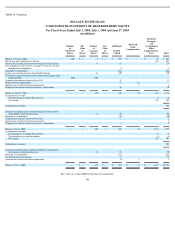

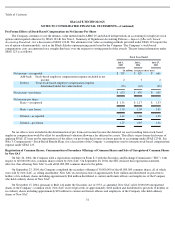

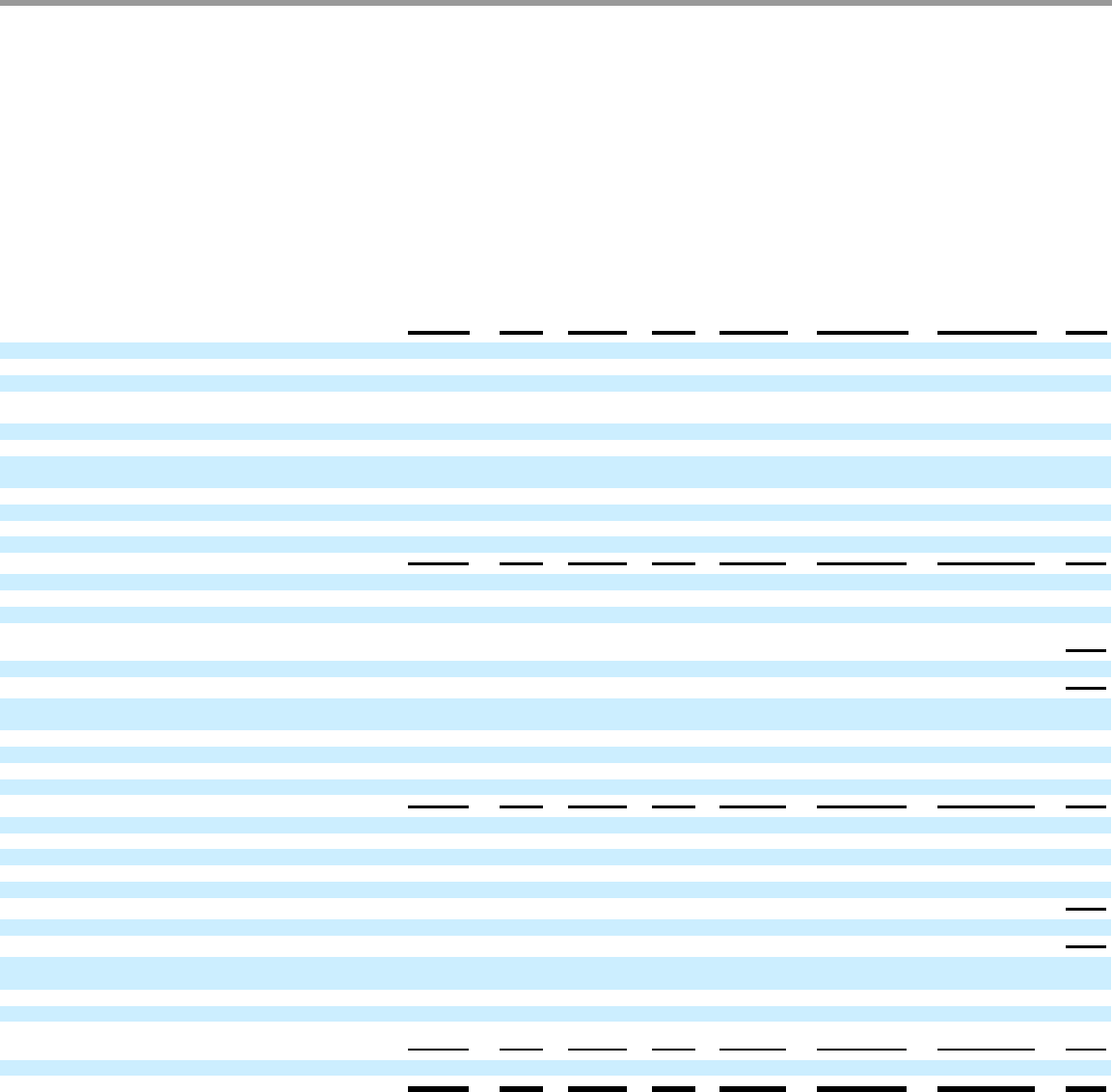

SEAGATE TECHNOLOGY

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

For Fiscal Years Ended July 1, 2005, July 2, 2004 and June 27, 2003

(in millions)

See notes to consolidated financial statements.

66

Number

of

Preferred

Shares

Par

Value

of

Shares

Number

of

Common

Shares

Par

Value

of

Shares

Additional

Paid-in

Capital

Deferred

Stock

Compensation

Retained

Earnings

and

Accumulated

Other

Comprehensive

Loss

Total

Balance at June 28, 2002

400

$

—

2

$

—

$

598

$ —

$

43

$

641

Net income and comprehensive Income

642

642

Issuance of common shares related to employee stock options

13

29

29

Sale of Xiotech to New SAC in exchange for $32 note payable

distributed to shareholders

(1

)

(1

)

Dividends to shareholders

(288

)

(288

)

Issuance of common shares in initial public offering

24

270

270

Conversion of preferred shares into common shares upon initial

public offering

(400

)

400

Compensation expense related to New SAC

11

11

Deferred stock compensation

11

(11

)

—

Amortization of deferred stock compensation

2

2

Compensation expense related to executive terminations

10

10

Balance at June 27, 2003

—

—

439

—

640

(9

)

685

1,316

Comprehensive income:

Unrealized loss on marketable securities

(3

)

(3

)

Net income

529

529

Comprehensive income

526

Issuance of common shares related to employee stock options

and employee stock purchase plan

21

96

96

Dividends to shareholders

(90

)

(90

)

Compensation expense related to New SAC

2

2

Amortization of deferred stock compensation

3

3

Compensation expense related to executive terminations

2

2

Balance at July 2, 2004

—

—

460

—

650

(6

)

1,211

1,855

Comprehensive income:

Unrealized loss on marketable securities

(3

)

(3

)

Unrealized loss on cash flow hedges

(3

)

(3

)

Net income

707

707

Comprehensive income

701

Issuance of common shares related to employee stock options

and employee stock purchase plan

17

90

90

Dividends to shareholders

(122

)

(122

)

Tax benefit from stock options

15

15

Amortization of deferred stock compensation

(1

)

3

2

Balance at July 1, 2005

—

$

—

477

$

—

$

632

$

(3

)

$

1,912

$

2,541