Seagate 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

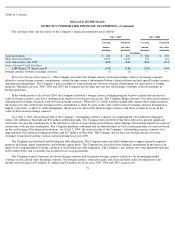

The Company’s recording of deferred tax assets each period depends primarily on the Company’s ability to generate current and future

taxable income in the United States. Each period the Company evaluates the need for a valuation allowance for the deferred tax assets and

adjusts the valuation allowance so that net deferred tax assets are recorded only to the extent the Company concludes it is more likely than not

that these deferred tax assets will be realized.

The Company also has other key accounting policies and accounting estimates relating to uncollectible customer accounts and valuation

of inventory. The Company believes that these other accounting policies and other accounting estimates either do not generally require it to

make estimates and judgments that are as difficult or as subjective, or it is less likely that they would have a material impact on its reported

results of operations for a given period.

Basis of Consolidation —The consolidated financial statements include the accounts of the Company and all its wholly-owned

subsidiaries, after eliminations of intercompany transactions and balances.

The Company operates and reports financial results on a fiscal year of 52 or 53 weeks ending on the Friday closest to June 30.

Accordingly, fiscal year 2005 comprised 52 weeks and ended on July 1, 2005, fiscal year 2004 comprised 53 weeks and ended on July 2, 2004

and fiscal year 2003 comprised 52 weeks and ended on June 27, 2003, respectively. All references to years in these notes to consolidated

financial statements represent fiscal years unless otherwise noted. Fiscal year 2006 will be 52 weeks and will end on June 30, 2006.

Revenue Recognition, Sales Returns and Allowances, and Sales Incentive Programs —The Company’s revenue recognition policy

complies with Staff Accounting Bulletin No. 101/104, “Revenue Recognition in Financial Statements.” Revenue from sales of products,

including sales to distribution customers, is generally recognized when title and risk of loss has passed to the buyer, which typically occurs

upon shipment from the Company or third party warehouse facilities, persuasive evidence of an arrangement exists, including a fixed price to

the buyer, and when collectibility is reasonably assured. For our direct retail customers, revenue is recognized on a sell-through basis and such

sales have not been material to date. Estimated product returns are provided for in accordance with Statement of Financial Accounting

Standards (“SFAS”) No. 48, “Revenue Recognition When Right of Return Exists.” The Company also adheres to the requirements of

Emerging Issue Task Force (“EITF”) No. 01-09 “Accounting for Consideration Given by a Vendor to a Customer,” (“EITF 01-09”) for sales

incentive programs. The Company follows Financial Accounting Standards Board (“FASB”) Technical Bulletin 90-1 , “Accounting for

Separately Priced Extended Warranty and Product Maintenance contracts” for sales of extended warranties.

Estimated reductions to revenue for sales incentive programs, such as price protection, and sales growth bonuses, are recorded when

revenue is recorded. Marketing development programs are either recorded as a reduction to revenue or as an addition to marketing expense

depending on the contractual nature of the program and whether the conditions of EITF 01-09 have been met.

Product Warranty —Enterprise products that are used in large scale servers and data warehousing systems are warranted for three to five

years while personal storage products used in consumer and commercial desktop systems are warranted for one to five years. Effective June 1,

2004, the Company extended its standard warranty from one year to five years on all internal desktop and notebook disc drives shipped through

the distribution and retail channels. A provision for estimated future costs relating to warranty expense is recorded when revenue is recorded

and is included in cost of revenue. The Company offers extended warranties on certain of its products. Deferred revenue in relation to extended

warranties has not been material to date. Shipping and handling costs are also included in cost of revenue.

Inventory —Inventories are valued at the lower of cost (which approximates actual cost using the first-in, first-out method) or market.

Market value is based upon an estimated average selling price reduced by estimated cost of completion and disposal.

68