Seagate 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our principal sources of liquidity as of July 1, 2005 consisted of: (1) $1.836 billion in cash, cash equivalents, and short-term investments,

(2) a $150 million revolving credit facility, of which $35 million had been used for outstanding letters of credit and bankers’ guarantees as of

July 1, 2005, and (3) cash we expect to generate from operations.

Our principal liquidity requirements are to service our debt and meet our working capital, research and development and capital

expenditure needs. In addition, since the second half of fiscal year 2002 and through fiscal years 2003, 2004 and 2005, we have paid dividends

to our shareholders.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next 12

months. Our ability to fund these requirements and comply with the financial covenants under our debt agreements will depend on our future

operations, performance and cash flow and is subject to prevailing economic conditions and financial, business and other factors, some of

which are beyond our control. In addition, as part of our strategy, we may selectively pursue strategic alliances, acquisitions and investments

that are complementary to our business. Any material future acquisitions, alliances or investments will likely require additional capital. We

cannot assure you that additional funds from available sources will be available on terms acceptable to us, or at all.

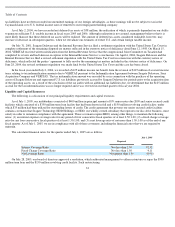

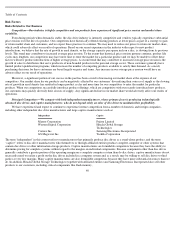

Our contractual cash obligations and commitments as of July 1, 2005 have been summarized in the table below (in millions):

Fiscal Year(s)

Total

2006

2007-

2008

2009-

2010

Thereafter

Contractual Cash Obligations:

Long term debt

$

740

$

4

$

336

$

400

$

—

Capital expenditures

267

267

—

—

—

Operating leases (1)

144

23

14

8

99

Purchase obligations (2)

1,428

1,331

59

38

—

Subtotal

2,579

1,625

409

446

99

Commitments:

Letters of credit or bank guarantees

35

35

—

—

—

Total

$

2,614

$

1,660

$

409

$

446

$

99

(1)

Includes total future minimum rent expense under non-cancelable leases for both occupied and abandoned facilities (rent expense is

shown net of sublease income).

Off-Balance Sheet Arrangements

(2)

Purchase obligations are defined as contractual obligations for purchase of goods or services, which are enforceable and legally binding

on us, and that specify all significant terms.

As of July 1, 2005, we did not have any material off-balance sheet arrangements (as defined in Item 303(a)(4)(ii) of Regulation S-K).

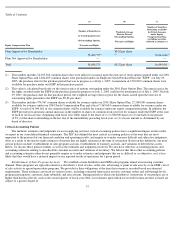

Equity Compensation Plan Information

The following table sets forth, for each of our existing equity compensation plans, the number of common shares issuable upon exercise

of outstanding options, warrants and rights, the weighted-

average exercise price of the outstanding options, warrants and rights, and the number

of common shares remaining available for issuance under such plans as of the end of fiscal year 2005.

36