Seagate 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Amortization of leasehold improvements is included in depreciation expense. Depreciation expense was $459 million, $416 million and

$390 million for fiscal years 2005, 2004 and 2003, respectively.

Intangibles

Other intangible assets consist of licensed technology. Amortization of purchased intangibles is provided on a straight-line basis over the

respective useful lives of the assets of 60 months. The carrying value of intangible assets at July 1, 2005 and July 2, 2004 was immaterial.

Accumulated amortization of intangibles was $6 million and $4 million at July 1, 2005 and July 2, 2004, respectively.

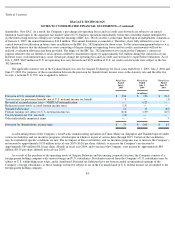

Supplemental Cash Flow Information

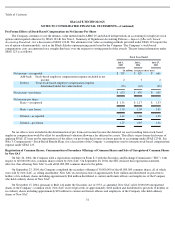

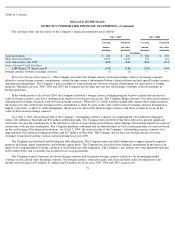

The components of depreciation and amortization expense are as follows:

Long-Term Debt and Credit Facilities

Fiscal Years Ended

July 1,

2005

July 2,

2004

June 27,

2003

(in millions)

Depreciation

$

459

$

416

$

390

Amortization:

Intangibles

2

1

2

Deferred compensation

2

8

12

Other assets

3

(3

)

39

$

466

$

422

$

443

The Company’s senior secured credit facilities, comprised of a five-year $350 million term loan facility and a $150 million revolving

credit facility, are secured by a first priority pledge of substantially all the tangible and intangible assets of Seagate Technology HDD Holdings

(“HDD”), the Company’s wholly-owned direct subsidiary, and many of HDD’s subsidiaries. The Company and many of its direct and indirect

subsidiaries have guaranteed the obligations under the senior secured credit facilities. HDD has also issued $400 million aggregate principal

amount of 8% senior notes due 2009. The Company has guaranteed HDD’s obligations under the 8% senior notes on a full and unconditional

basis. See Note 13, Condensed Consolidating Financial Information. Neither the credit agreement governing the senior secured credit facilities

nor the indenture governing the outstanding 8% senior notes due 2009 impose any restrictions on the ability of the Company’s consolidated

subsidiaries to transfer funds to HDD in the form of dividends, loans or advances.

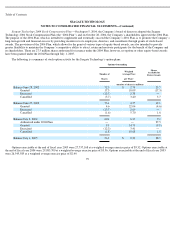

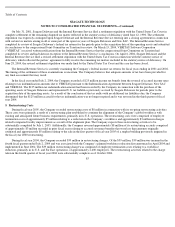

Long-term debt consisted of the following:

77

July 1,

2005

July 2,

2004

(in millions)

LIBOR plus 2.0% term loan B

$

340

$

343

8.0% senior notes due 2009

400

400

740

743

Less current portion

4

4

Long

-

term debt, less current portion

$

736

$

739