Seagate 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(a)

(b)

(c)

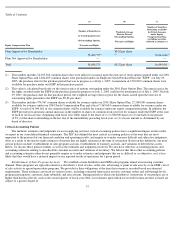

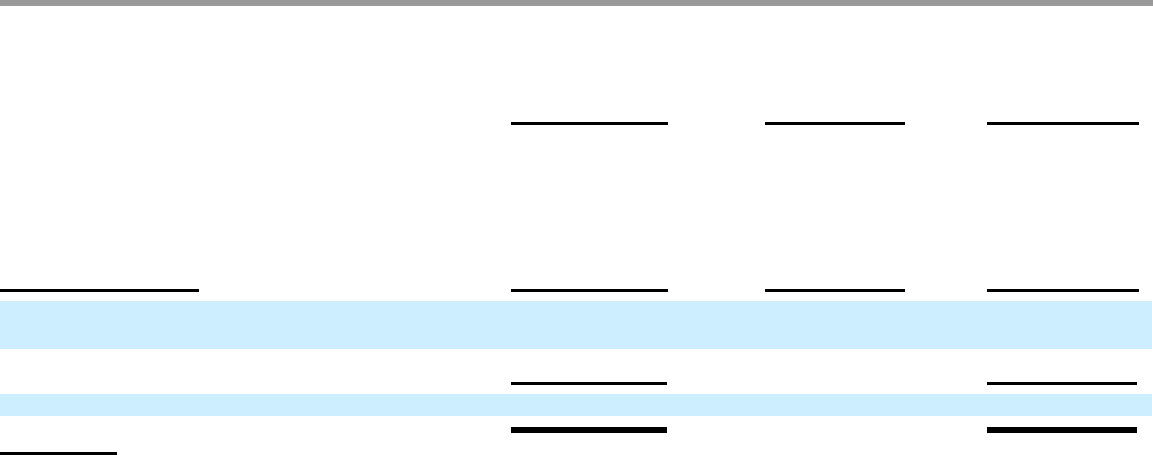

Equity Compensation Plan

Number of Securities to

be Issued upon Exercise

of Outstanding Options,

Warrants and Rights

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(excluding securities

reflected in column (a))

Plans Approved by Shareholders

58,689,575

(1)

$8.32 per share

(2)

36,044,661

(3)

Plans Not Approved by Shareholders

—

—

—

Total

58,689,575

$8.32 per share

36,044,661

(1)

This number includes 56,205,366 common shares that were subject to issuance upon the exercise of stock options granted under our 2001

Share Option Plan, and 2,484,209 common shares were purchased under our Employee Stock Purchase Plan (the “ESPP”) on July 29,

2005, the purchase date for the purchase period that was in progress as of July 1, 2005. A maximum of 2,500,000 common shares were

available for purchase under our ESPP in that purchase period.

(2)

This value is calculated based only on the exercise price of options outstanding under the 2001 Share Option Plan. The exercise price for

the rights awarded under the ESPP in the purchase period in progress on July 1, 2005 could not be determined as of July 1, 2005. On July

29, 2005, the purchase date for that purchase period, the weighted average exercise price for the shares issued upon the exercise of

outstanding rights pursuant to the ESPP was $9.82 per share.

Critical Accounting Policies

(3)

This number includes 974,967 common shares available for issuance under our 2001 Share Option Plan, 27,500,000 common shares

available for issuance under our 2004 Stock Compensation Plan and at least 7,569,694 common shares available for issuance under our

ESPP. A total of 36,044,661 of our common shares will be available for issuance under our equity compensation plans. In addition, the

ESPP provides for automatic annual increases in the number of shares of common stock reserved for issuance under the ESPP at the start

of each of our fiscal years (beginning with fiscal year 2004) equal to the lesser of (1) 2,500,000 shares or (2) one half of one percent

(0.5%) of the shares outstanding on the last day of the immediately preceding fiscal year, or (3) a lesser amount as determined by our

board of directors.

The methods, estimates and judgments we use in applying our most critical accounting policies have a significant impact on the results

we report in our consolidated financial statements. The SEC has defined the most critical accounting policies as the ones that are most

important to the portrayal of our financial condition and operating results, and require us to make our most difficult and subjective judgments,

often as a result of the need to make estimates of matters that are highly uncertain at the time of estimation. Based on this definition, our most

critical policies include: establishment of sales program accruals, establishment of warranty accruals, and valuation of deferred tax assets.

Below, we discuss these policies further, as well as the estimates and judgments involved. We also have other key accounting policies and

accounting estimates relating to uncollectible customer accounts and valuation of inventory. We believe that these other accounting policies

and accounting estimates either do not generally require us to make estimates and judgments that are as difficult or as subjective, or it is less

likely that they would have a material impact on our reported results of operations for a given period.

Establishment of Sales Program Accruals. We establish certain distributor and OEM sales programs aimed at increasing customer

demand. These programs are typically related to a distributor’s level of sales, order size, advertising or point of sale activity or an OEM’s level

of sale activity or agreed upon rebate programs. We provide for these obligations at the time that revenue is recorded based on estimated

requirements. These estimates are based on various factors, including estimated future price erosion, customer orders and sell-through levels,

program participation, customer claim submittals and sales returns. During periods in which our distributors’ inventories of our products are at

higher than historical levels, such as the second quarter of fiscal year 2004, our estimates upon which our recorded contra-revenue is based are

subject to a greater degree of

37