Seagate 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

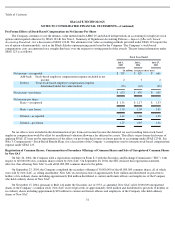

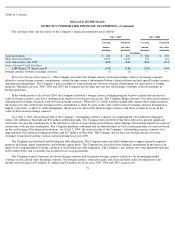

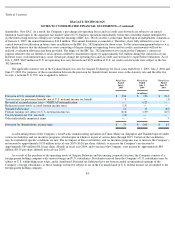

At July 1, 2005, future minimum principal payments on long-term debt were as follows:

As of July 1, 2005, the Company had $35 million of outstanding standby letters of credit and bankers’ guarantees issued under its $150

million revolving credit facility.

The Company is restricted in its ability to pay dividends to its shareholders by the covenants contained in the indenture governing its

senior notes and the credit agreement governing its senior secured credit facilities. The covenants contained in the indenture governing the

Company’s senior notes limit the aggregate amount of restricted payments, including dividends to shareholders, to 50% of cumulative

consolidated net income plus 100% of net cash proceeds received from the issuance of capital, all of which are measured from the period

beginning June 30, 2001 and ending the most recent fiscal quarter for which financial statements are internally available. Currently, the most

significant restriction on the Company’s ability to pay dividends is under the credit agreement governing the Company’s senior secured credit

facilities, which limits annual dividends to $150 million. The Company’s declaration of dividends is also subject to Cayman Islands law and

the discretion of its board of directors.

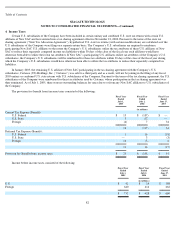

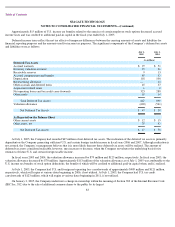

3. Compensation

Fiscal Year

2006

$

4

2007

336

2008

—

2009

400

2010

—

Thereafter

—

$

740

Tax-Deferred Savings Plan

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (“the 401(k) plan”), for the benefit of qualified employees. The

401(k) plan is designed to provide employees with an accumulation of funds at retirement. Qualified employees may elect to make

contributions to the 401(k) plan on a monthly basis. The Company may make annual contributions at the discretion of its board of directors.

During fiscal years 2005, 2004 and 2003, the Company made contributions of $13 million, $14 million and $15 million, respectively.

Stock-Based Benefit Plans

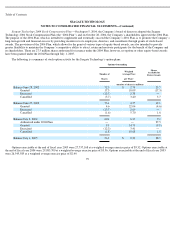

Seagate Technology 2001 Share Option Plan —In December 2000, the Company’s board of directors adopted the Seagate Technology

2001 Share Option Plan (the “2001 Plan”). Under the terms of the 2001 Plan, eligible employees, directors, and consultants can be awarded

options to purchase common shares of the Company under vesting terms to be determined at the date of grant. In January 2002, the Company

increased the maximum number of common shares issuable under the 2001 Plan from 72 million to 100 million. No options to purchase the

Company’s common shares had been issued through June 29, 2001. From July 1, 2001 through July 1, 2005, options to purchase 99,025,033

common shares were granted to employees under the 2001 plan, net of cancellations. Options granted to exempt employees will generally vest

as follows: 25% of the shares will vest on the first anniversary of the vesting commencement date and the remaining 75% will vest

proportionately each month over the next 36 months. Options granted to non-exempt employees will vest on the first anniversary of the vesting

commencement date. Except for certain options granted below fair market value in fiscal year 2003 (see Deferred Stock Compensation), all

other options granted under the 2001 Plan were granted at fair market value, with options granted up through September 5, 2004 expiring ten

years from the date of grant and options granted subsequent to September 5, 2004 expiring seven years from the date of grant.

78