Seagate 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

a portion of the costs it may incur in the clean-up of contamination at most sites. In the opinion of management, including internal counsel, the

probability is remote that the losses to the Company arising from these environmental matters would be material to the Company’s financial

position, cash flows or results of operations.

Other Matters

We are involved in a number of other judicial and administrative proceedings incidental to our business, and we may be involved in

various legal proceedings arising in the normal course of our business in the future. Although occasional adverse decisions or settlements may

occur, we believe that the final disposition of such matters will not have a material adverse effect on our financial position or results of

operations.

10. Sale of Xiotech Corporation

On November 4, 2002, the Company sold Xiotech Corporation, the wholly-owned indirect subsidiary that operated the Company’s

storage area networks business, to New SAC. New SAC in turn sold 51% of Xiotech to a third party in a transaction in which Xiotech sold

newly issued shares to this third party. As a result, New SAC has retained an interest of less than 20% of Xiotech.

In consideration of the Company’s sale of Xiotech to New SAC, the Company received a $32 million promissory note from New SAC.

The amount of this promissory note was equal to the estimated fair value of Xiotech as of the date of the sale, net of intercompany

indebtedness. Immediately after the sale of Xiotech to New SAC, the Company made an in-kind pro rata distribution of the entire promissory

note to the holders of its then-

outstanding shares, including New SAC, which at the time owned approximately 99.4% of its outstanding shares.

That portion of the note distributed back to New SAC was cancelled, and New SAC immediately paid off the remaining 0.6% of the

promissory note held by the Company’s minority shareholders. As a result of the sale of Xiotech, the Company no longer consolidates

Xiotech’s operations with its operations.

11. Guarantees

Indemnifications to Officers and Directors

We have entered into indemnification agreement, a form of which is incorporated by reference in the exhibits of this report, with the

members of our Board of Directors to indemnify them to the extent permitted by law against any and all liabilities, costs, expenses, amounts

paid in settlement and damages incurred by the directors as a result of any lawsuit, or any judicial, administrative or investigative proceeding in

which the directors are sued as a result of their service as members of our Board of Directors.

Intellectual Property Indemnification Obligations

The Company has entered into agreements with customers and suppliers that include limited intellectual property indemnification

obligations that are customary in the industry. These guarantees generally require the Company to compensate the other party for certain

damages and costs incurred as a result of third party intellectual property claims arising from these transactions. The nature of the intellectual

property indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be

required to pay to its customers and suppliers. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

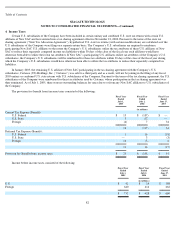

Product Warranty

The Company estimates probable product warranty costs at the time revenue is recognized. The Company generally warrants its products

for a period of one to five years. Effective June 1, 2004, we extended our standard

92