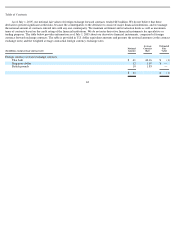

Seagate 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

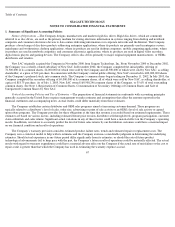

income tax purposes, distributions on our common shares will not be treated as a return of capital distribution and will be treated as dividend

income, taxable to U.S. shareholders. If during fiscal year 2006, we engage in activities such as the repayment of our term loan, the repurchase

of our common shares, etc., which require significant usage of cash beyond the normal quarterly distributions to shareholders, it is likely that

we would generate current earnings and profits. If this occurs, all distributions made during fiscal year 2006 are anticipated to be treated as

dividend income, even if the activities occur after the distributions are made.

Furthermore, we believe that we were a foreign personal holding company for U.S. federal income tax purposes for our taxable years

ended July 1, 2005 and July 2, 2004. Pursuant to the American Jobs Creation Act of 2004, foreign corporations will be excluded from the

application of the personal holding company rules of the Internal Revenue Code of 1986, as amended (the “Code”), effective for taxable years

of foreign corporations beginning after December 31, 2004. For the Company, the effective date is its fiscal year beginning July 2, 2005. As a

result, if taxable distributions on our common shares are made after July 1, 2005, U.S. shareholders who are individuals may be eligible for

reduced rates of taxation applicable to certain dividend income (currently a maximum rate of 15%) on distributions made after the effective

date.

Because we are a foreign corporation, for corporate shareholders, the dividends will not be eligible for the dividends-received deduction

generally allowed to U.S. corporations in respect of dividends received from other U.S. corporations. Dividends will be income from sources

outside the United States.

Potential Governmental Action—Governmental action against companies located in offshore jurisdictions may lead to a reduction in

the demand for our common shares.

Recent federal and state legislation has been proposed, and additional legislation may be proposed in the future which, if enacted, could

have an adverse tax impact on either the Company or its shareholders. For example, the eligibility for favorable tax treatment of taxable

distributions paid to U.S. shareholders of the Company as qualified dividends could be eliminated.

Securities Litigation—Significant fluctuations in the market price of our common shares could result in securities class action claims

against us.

Significant price and value fluctuations have occurred with respect to the publicly traded securities of disc drive companies and

technology companies generally. The price of our common shares is likely to be volatile in the future. In the past, following periods of decline

in the market price of a company’s securities, class action lawsuits have often been pursued against that company. If similar litigation were

pursued against us, it could result in substantial costs and a diversion of management’s attention and resources, which could materially

adversely affect our results of operations, financial condition and liquidity.

Limited Protection of Shareholder Interests—

Holders of the common shares may face difficulties in protecting their interests because

we are incorporated under Cayman Islands law.

Our corporate affairs are governed by our third amended and restated memorandum and articles of association, by the Companies Law

(2004 Revision) and the common law of the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors

under Cayman Islands law are not as clearly established as under statutes or judicial precedent in existence in jurisdictions in the United States.

Therefore, you may have more difficulty in protecting your interests in the face of actions by our management, directors or controlling

shareholder than would shareholders of a corporation incorporated in a jurisdiction in the United States, due to the comparatively less

developed nature of Cayman Islands law in this area.

Unlike many jurisdictions in the United States, Cayman Islands law does not specifically provide for shareholder appraisal rights on a

merger or consolidation of a company. This may make it more difficult for you to assess the value of any consideration you may receive in a

merger or consolidation or to require that the offeror give you additional consideration if you believe the consideration offered is insufficient.

59