Seagate 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

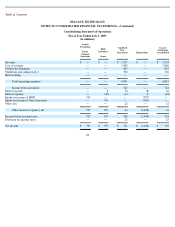

8. Commitments

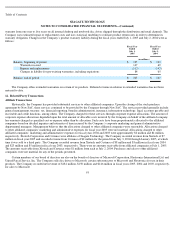

Leases —The Company leases certain property, facilities and equipment under non-cancelable lease agreements. Land and facility leases

expire at various dates through 2027 and contain various provisions for rental adjustments including, in certain cases, a provision based on

increases in the Consumer Price Index. All of the leases require the Company to pay property taxes, insurance and normal maintenance costs.

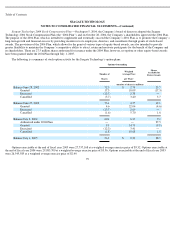

Future minimum lease payments for operating leases with initial or remaining terms of one year or more were as follows at July 1, 2005

(lease payments are shown net of sublease income):

Total rent expense for all land, facility and equipment operating leases was approximately $19 million, $23 million, and $24 million for

fiscal years 2005, 2004 and 2003, respectively. Total sublease rental income for fiscal years 2005, 2004 and 2003 was $6 million, $6 million,

and $8 million, respectively. The Company subleases a portion of its facilities that it considers to be in excess of current requirements. Total

future lease income to be recognized for the Company’s existing subleases is approximately $12 million.

Capital Expenditures —The Company’s commitments for construction of manufacturing facilities and equipment approximated

$267 million at July 1, 2005.

9. Legal, Environmental, and Other Contingencies

Operating

Leases

(in millions)

2006

$

23

2007

7

2008

7

2009

5

2010

3

Thereafter

99

$

144

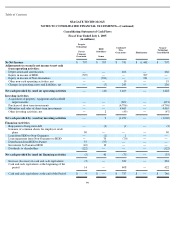

Intellectual Property Litigation

Convolve, Inc. and Massachusetts Institute of Technology (“MIT”) v. Seagate Technology LLC, et al. Between 1998 and 1999,

Convolve, Inc., a small privately held technology consulting firm founded by an MIT Ph.D., engaged in discussions with Seagate Technology,

Inc. with respect to the potential license of technology that Convolve claimed to own. During that period, the parties entered into non-

disclosure agreements. We declined Convolve’s offer of a license in late 1999. On July 13, 2000, Convolve and MIT filed suit against Compaq

Computer Corporation and us in the U.S. District Court for the Southern District of New York, alleging patent infringement, misappropriation

of trade secrets, breach of contract, tortious interference with contract and fraud relating to Convolve and MIT’s Input Shaping

®

and

Convolve’s Quick and Quiet

™

technology. The plaintiffs claim their technology is incorporated in our sound barrier technology, which was

publicly announced on June 6, 2000. The complaint seeks injunctive relief, $800 million in compensatory damages and unspecified punitive

damages. We answered the complaint on August 2, 2000 and filed counterclaims for declaratory judgment that two Convolve/MIT patents are

invalid and not infringed and that we own any intellectual property based on the information that we disclosed to Convolve. The court denied

plaintiffs’ motion for expedited discovery and ordered plaintiffs to identify their trade secrets to defendants before discovery could begin.

Convolve served a trade secrets disclosure on August 4, 2000, and we filed a motion challenging the disclosure statement. On May 3, 2001, the

court appointed a special master to review the trade secret issues. The special

89