Seagate 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

tax liabilities have not been recorded on unremitted earnings of our foreign subsidiaries, as these earnings will not be subject to tax in the

Cayman Islands or to U.S. federal income taxes if remitted to our foreign parent holding company.

As of July 2, 2004, we have recorded net deferred tax assets of $58 million, the realization of which is primarily dependent on our ability

to generate sufficient U.S. taxable income in fiscal years 2005 and 2006. Although realization is not assured, management believes that it is

more likely than not that these deferred tax assets will be realized. The amount of deferred tax assets considered realizable, however, may

increase or decrease in subsequent quarters, when we reevaluate our estimates of future U.S. and certain foreign taxable income.

On July 31, 2001, Seagate Delaware and the Internal Revenue Service filed a settlement stipulation with the United States Tax Court in

complete settlement of the remaining disputed tax matters reflected in the statutory notice of deficiency dated June 12, 1998. On March 15,

2004, VERITAS received written notification from the Internal Revenue Service that the congressional Joint Committee on Taxation had

completed its review and had taken no exception to the Internal Revenue Service’s conclusions. On April 6, 2004, Seagate Delaware and the

Internal Revenue Service filed a revised settlement stipulation with the United States Tax Court in connection with the statutory notice of

deficiency, which reflected the parties’ agreement to fully resolve the remaining tax matters included in the statutory notice of deficiency. On

June 28, 2004, the revised settlement stipulation was made final by the United States Tax Court and the case has been closed.

In the fiscal year ended July 2, 2004, we recorded a $125 million income tax benefit from the reversal of $125 million of accrued income

taxes relating to tax indemnification amounts due to VERITAS pursuant to the Indemnification Agreement between Seagate Delaware, Suez

Acquisition Company and VERITAS. The tax indemnification amount was recorded by us in connection with the purchase of the operating

assets of Seagate Delaware and represented U.S. tax liabilities previously accrued by Seagate Delaware for periods prior to the acquisition date

of the operating assets. As a result of the conclusion of the tax audits with no additional tax liabilities due, we determined that the $125 million

accrual for the tax indemnification was no longer required and it was reversed in our third quarter of fiscal year 2004.

Liquidity and Capital Resources

The following is a discussion of our principal liquidity requirements and capital resources.

As of July 1, 2005, our indebtedness consisted of $400 million in principal amount of 8% senior notes due 2009 and senior secured credit

facilities which consisted of a $350 million term loan facility that had been drawn in full and a $150 million revolving credit facility, under

which $35 million had been utilized for outstanding letters of credit. The credit agreement that governs our senior secured credit facilities

contains covenants that Seagate Technology HDD Holdings, or HDD, our wholly-owned subsidiary that operates our disc drive business, must

satisfy in order to remain in compliance with the agreement. These covenants require HDD, among other things, to maintain the following

ratios: (1) an interest expense coverage ratio for any period of four consecutive fiscal quarters of at least 2.50:1.00; (2) a fixed charge coverage

ratio for any four consecutive fiscal quarters of at least 1.50:1.00; and (3) a net leverage ratio of not more than 1.50:1.00 as of the end of any

fiscal quarter. As of July 1, 2005, we are in compliance with all of these covenants, including the financial ratios that we are required to

maintain.

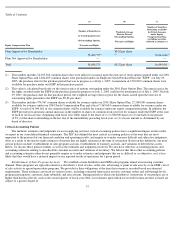

The calculated financial ratios for the quarter ended July 1, 2005 are as follows:

On July 28, 2005, our board of directors approved a resolution, which authorized management to either restructure or repay the $350

million term loan and the $150 million revolving credit facility. Such restructuring

33

Required

July 1, 2005

Interest Coverage Ratio

Not less than 2.50

92.32

Fixed Charge Coverage Ratio

Not less than 1.50

4.11

Net Leverage Ratio

Not greater than 1.50

(0.90

)