Seagate 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

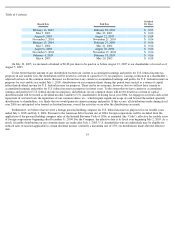

Year Ended June 27, 2003

Includes a $10 million write-down in our investment in a private company and a $9 million net restructuring charge.

Year Ended June 28, 2002

Includes a $179 million charge to record $32 million paid to participants in our deferred compensation plan and $147 million to accrue

the remaining obligations under the plan, $93 million in debt refinancing charges, and a $4 million net restructuring charge.

Period Ended June 29, 2001

Includes a $66 million net restructuring charge and a $52 million write-off of in-

process research and development incurred in connection

with the November 2000 transactions.

Period Ended November 22, 2000

Includes $567 million of non-cash compensation expense related to the November 2000 transactions and losses recognized on

investments in Lernout & Hauspie Speech Products N.V. and Gadzoox Networks, Inc., losses on the sale of marketable securities of $138

million, $8 million and $8 million, respectively, partially offset by gains on the sale of Veeco Instruments, Inc. stock of $20 million, and $19

million in restructuring charges.

21