Seagate 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

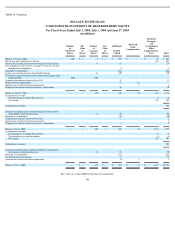

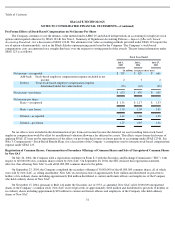

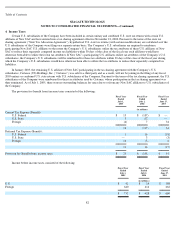

The carrying values and fair values of the Company’s financial instruments are as follows:

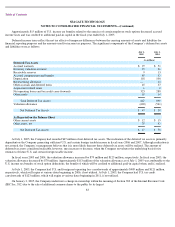

Derivative Financial Instruments —The Company may enter into foreign currency forward exchange contracts to manage exposure

related to certain foreign currency commitments, certain foreign currency denominated balance sheet positions and anticipated foreign currency

denominated expenditures. The Company’s policy prohibits it from entering into derivative financial instruments for speculative or trading

purposes. During fiscal years 2005, 2004 and 2003, the Company did not enter into any fair value hedges or hedges of net investments in

foreign operations.

In the fourth quarter of fiscal year 2004, the Company instituted a foreign currency hedging program to protect against the increase in

value of foreign currency cash flows resulting from expenses over the next fiscal year. The Company hedges portions of its forecasted expenses

denominated in foreign currencies with forward exchange contracts. When the U.S. dollar weakens significantly against the foreign currencies,

the increase in value of the future foreign currency expenditure is offset by gains in the value of the forward exchange contracts designated as

hedges. Conversely, as the U.S. dollar strengthens, the decrease in value of the future foreign currency cash flows is offset by losses in the

value of the forward exchange contracts.

As at July 1, 2005, the notional value of the Company’s outstanding currency contracts was approximately $12 million in Singapore

dollars, $41 million in Thai baht and $10 million in British pounds. The Company does not believe that these derivatives present significant

credit risks, because the counterparties to the derivatives consist of major financial institutions, and it manages the notional amount on contracts

entered into with any one counterparty. The Company maintains settlement and revaluation limits as well as maximum tenor of contracts based

on the credit rating of the financial institutions. As at July 2, 2004, the notional value of the Company’s outstanding currency contracts was

approximately $20 million in Singapore dollars and $27 million in Thai baht. The Company did not have any foreign currency forward

exchange or purchased currency option contracts during fiscal year 2003.

The Company has both fixed and floating rate debt obligations. The Company enters into debt obligations to support general corporate

purposes including capital expenditures and working capital needs. The Company has used derivative financial instruments in the form of an

interest rate swap agreement to hedge a portion of our floating rate debt obligations. The Company’s last interest rate swap agreement matured

in November 2002, and it currently has no interest rate swap agreements.

The Company transacts business in various foreign countries and its primary foreign currency cash flows are in emerging market

countries in Asia and in some European countries. Net foreign currency transaction gains and losses included in the determination of net

income were net gains of $3 million, $1 million and $1 million for fiscal years 2005, 2004 and 2003, respectively.

75

July 1, 2005

July 2, 2004

Carrying

amount

Estimated

fair value

Carrying

amount

Estimated

fair value

(in millions)

Cash equivalents

$

676

$

676

$

336

$

336

Short

-

term investments

1,090

1,090

761

761

8.0% senior notes, due 2009

(400

)

(426

)

(400

)

(414

)

Senior Secured Credit Facilities:

LIBOR plus 2% Term Loan B

(340

)

(340

)

(343

)

(343

)

Foreign currency forward exchange contracts

(1

)

(1

)

—

—