Seagate 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

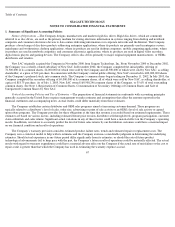

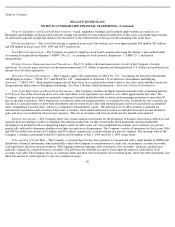

Property, Equipment, and Leasehold Improvements —Land, equipment, buildings and leasehold improvements are stated at cost.

Equipment and buildings are depreciated using the straight-line method over the estimated useful lives of the assets. Leasehold improvements

are amortized using the straight-line method over the shorter of the estimated life of the asset or the remaining term of the lease.

Advertising Expense —The cost of advertising is expensed as incurred. Advertising costs were approximately $26 million, $25 million

and $28 million in fiscal years 2005, 2004 and 2003, respectively.

Stock-Based Compensation —The Company accounts for employee stock-based compensation using the intrinsic value method under

Accounting Principles Board Opinion (“APBO”) No. 25, “Accounting for Stock Issued to Employees” (“APBO 25”), and related

interpretations.

Foreign Currency Remeasurement and Translation —The U.S. dollar is the functional currency for all of the Company’s foreign

operations. As a result, gains and losses on the remeasurement into U.S. dollars of amounts not denominated in U.S. dollars are included in net

income (loss) for those operations.

Derivative Financial Instruments —The Company applies the requirements of SFAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities” (“SFAS 133”) and SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging

Activities,” (“SFAS 149”). Both standards require that all derivatives be recorded on the balance sheet at fair value and establishes criteria for

designation and effectiveness of hedging relationships. See Note 2, Balance Sheet Information— Derivative Financial Instruments.

Cash, Cash Equivalents and Short-Term Investments —The Company considers all highly liquid investments with a remaining maturity

of 90 days or less at the time of purchase to be cash equivalents. Cash equivalents are carried at cost, which approximates fair value. The

Company’s short-term investments are primarily comprised of readily marketable debt securities with remaining maturities of more than 90

days at the time of purchase. The Company has classified its entire investment portfolio as available-for-sale. Available-for-sale securities are

classified as cash equivalents or short-term investments and are stated at fair value with unrealized gains and losses included in accumulated

other comprehensive income (loss), which is a component of shareholders’ equity. The amortized cost of debt securities is adjusted for

amortization of premiums and accretion of discounts to maturity. Such amortization and accretion are included in interest income. Realized

gains and losses are included in other income (expense). The cost of securities sold is based on the specific identification method.

Strategic Investments —The Company enters into certain strategic investments for the promotion of business and strategic objectives and

typically does not attempt to reduce or eliminate the inherent market risks on these investments. Both marketable and non-marketable

investments are included in the accompanying balance sheets in other assets, net. Non-marketable investments are recorded at cost and are

periodically analyzed to determine whether or not there are indicators of impairment. The Company’

s results of operations for fiscal years 2004

and 2003 included write-downs of $2 million and $10 million, respectively, in an investment in a private company. The carrying value of the

Company’s strategic investments totaled $15 million and $6 million at July 1, 2005 and July 2, 2004, respectively.

Concentration of Credit Risk —The Company’s customer base for disc drive products is concentrated with a small number of OEMs and

distributors. Financial instruments, which potentially subject the Company to concentrations of credit risk, are primarily accounts receivable,

cash equivalents and short-term investments. The Company performs ongoing credit evaluations of its customers’ financial condition and,

generally, requires no collateral from its customers. The allowance for doubtful accounts is based upon the expected collectibility of all

accounts receivable. The Company places its cash equivalents and short-term investments in investment-grade, short-

term debt instruments and

limits the amount of credit exposure to any one commercial issuer.

69