Seagate 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7A.

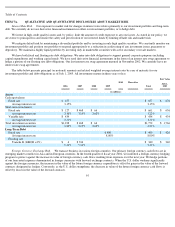

QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk. Our exposure to market risk for changes in interest rates relates primarily to our investment portfolio and long-term

debt. We currently do not use derivative financial instruments in either our investment portfolio, or to hedge debt.

We invest in high credit quality issuers and, by policy, limit the amount of credit exposure to any one issuer. As stated in our policy, we

are averse to principal loss and ensure the safety and preservation of our invested funds by limiting default risk and market risk.

We mitigate default risk by maintaining a diversified portfolio and by investing in only high quality securities. We constantly monitor our

investment portfolio and position our portfolio to respond appropriately to a reduction in credit rating of any investment issuer, guarantor or

depository. We maintain a highly liquid portfolio by investing only in marketable securities with active secondary or resale markets.

We have both fixed and floating rate debt obligations. We enter into debt obligations to support general corporate purposes including

capital expenditures and working capital needs. We have used derivative financial instruments in the form of an interest rate swap agreement to

hedge a portion of our floating rate debt obligations. Our last interest rate swap agreement matured in November 2002. We currently have no

interest rate swap agreements.

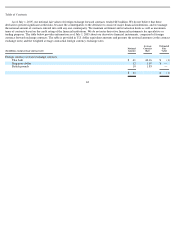

The table below presents principal (or notional) amounts and related weighted average interest rates by year of maturity for our

investment portfolio and debt obligations as of July 1, 2005. All investments mature in three years or less.

Foreign Currency Exchange Risk. We transact business in various foreign countries. Our primary foreign currency cash flows are in

emerging market countries in Asia and in European countries. In the fourth quarter of fiscal year 2004, we instituted a foreign currency hedging

program to protect against the increase in value of foreign currency cash flows resulting from expenses over the next year. We hedge portions

of our forecasted expenses denominated in foreign currencies with forward exchange contracts. When the U.S. dollar weakens significantly

against the foreign currencies, the increase in the value of the future foreign currency expenditure is offset by gains in the value of the forward

contracts designated as hedges. Conversely, as the U.S. dollar strengthens, the decrease in value of the future foreign currency cash flows is

offset by losses in the value of the forward contracts.

61

2006

2007

2008

2009

2010

Thereafter

Total

Fair Value

July 1,

2005

(in millions)

Assets

Cash equivalents:

Fixed rate

$

677

$

677

$

676

Average interest rate

3.15

%

3.15

%

Short

-

term investments:

Fixed rate

$

127

$

468

$

66

$

661

$

656

Average interest rate

3.10

%

3.19

%

3.62

%

3.22

%

Variable rate

$

434

$

434

$

434

Average interest rate

3.31

%

3.31

%

Total investment securities

$

1,238

$

468

$

66

$

1,772

$

1,766

Average interest rate

3.20

%

3.19

%

3.62

%

3.21

%

Long-Term Debt

Fixed rate

$

400

$

400

$

426

Average interest rate

8.00

%

8.00

%

Floating rate:

Tranche B (LIBOR +2%)

$

4

$

336

$

340

$

340

5.31

%

5.31

%

5.31

%