Seagate 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

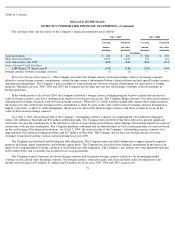

Supplier Concentration —Certain of the raw materials used by the Company in the manufacture of its products are available from a

limited number of suppliers. Shortages could occur in these essential materials due to an interruption of supply or increased demand in the

industry. If the Company were unable to procure certain of such materials, it would be required to reduce its manufacturing operations, which

could have a material adverse effect on its results of operations.

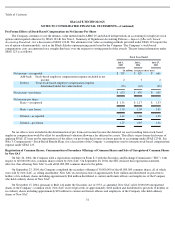

Impact of Recently Issued Accounting Standards —In November 2004, the FASB issued SFAS No. 151, “Inventory Costs” (“SFAS

151”). SFAS 151 amends Accounting Research Bulletin No. 43, Chapter 4, “Inventory Pricing.” This statement clarifies the accounting for

abnormal amounts of idle facility expense, freight, handling costs, and wasted material, and requires that these items be recognized as current

period charges regardless of whether they meet the criterion of “so abnormal.” Additionally, SFAS 151 requires that the allocation of fixed

production overheads to the costs of conversion be based on the normal capacity of the production facilities. Beginning with its first quarter of

fiscal year 2006, the Company will be required to adopt SFAS 151. The Company does not expect that the adoption of SFAS 151 will have a

material impact on its results of operations or financial position.

In December 2004, the FASB issued SFAS No. 123-R, “Share-Based Payment” (“SFAS 123-R”), which is a revision of SFAS 123,

“Accounting for Stock Compensation” (“SFAS 123”), and supersedes APBO 25, and its related implementation guidance. SFAS 123-R

clarifies and expands SFAS 123’s guidance in several areas, including measuring fair value, classifying an award as equity or as a liability, and

attributing compensation cost to reporting periods. Additionally, SFAS 123-R amends FASB Statement No. 95, “Statement of Cash Flows,” to

require that excess tax benefits be reported as a financing cash inflow rather than as reduction of taxes paid. Beginning with the Company’s

first quarter of fiscal year 2006, it will be required to adopt SFAS 123-R, and will recognize share-based compensation costs in its results of

operations. The Company currently provides pro forma disclosures under SFAS 123 reflecting the effects of share-

based compensation costs on

its results of operations in its notes to consolidated financial statements. See Note 1, Summary of Significant Accounting Policies – Pro Forma

Effects of Stock-Based Compensation on Net Income Per Share. Although such pro forma effects of applying SFAS 123 may be indicative of

the effects of adopting SFAS 123-R, the provisions of these two statements differ in some important respects. The actual effects of adopting

SFAS 123R will be dependent on numerous factors including, but not limited to, levels of share-based payments granted in the future and the

timing thereof; the valuation model chosen by the Company to value stock-based awards; the assumed award forfeiture rate; the accounting

policies adopted concerning the method of recognizing the fair value of awards over the service period; the potentially significant effect of

income taxes; and the transition method chosen for adopting SFAS 123-R, which permits public companies to adopt its requirements using

various methods, including the “modified prospective application method” and the “modified retrospective application method”. The Company

plans to adopt SFAS 123-R using the modified prospective application method. The Company expects that the adoption of SFAS 123-R will

have a material impact on its results of operations subsequent to adoption.

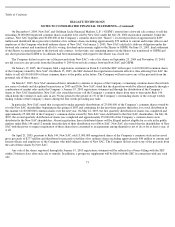

In June 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections” (“SFAS 154”). SFAS 154 replaces APBO

No. 20 (

“APBO 20”) and SFAS No. 3 “Reporting Accounting Changes in Interim Financial Statements”, and applies to all voluntary changes

in accounting principle, and changes the requirements for accounting for and reporting of a change in accounting principle. APBO 20

previously required that most voluntary changes in accounting principle be recognized by including in net income of the period of change a

cumulative effect of changing to the new accounting principle whereas SFAS 154 requires retrospective application to prior periods’ financial

statements of a voluntary change in accounting principle, unless it is impracticable. SFAS 154 enhances the consistency of financial

information between periods. SFAS 154 will be effective beginning with the Company’s first quarter of fiscal year 2006. The Company does

not expect that the adoption of SFAS 154 will have a material impact on its results of operations or financial position.

70