Seagate 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

One component of our business strategy is to make acquisitions. In the event of any future acquisitions, we could issue additional

common shares, which would have the effect of diluting your ownership percentage of the common shares and could cause the price of our

common shares to decline.

Volatile Public Markets—The price of our common shares may be volatile and could decline significantly.

The stock market in general, and the market for technology stocks in particular, has recently experienced volatility that has often been

unrelated to the operating performance of companies. If these market or industry-based fluctuations continue, the trading price of our common

shares could decline significantly independent of our actual operating performance, and you could lose all or a substantial part of your

investment. The market price of our common shares could fluctuate significantly in response to several factors, including among others:

•

actual or anticipated variations in our results of operations;

•

announcements of innovations, new products or significant price reductions by us or our competitors;

•

our failure to meet the performance estimates of investment research analysts;

•

the timing of announcements by us or our competitors of significant contracts or acquisitions;

•

general stock market conditions;

•

the occurrence of major catastrophic events;

•

changes in financial estimates by investment research analysts; and

Failure to Pay Quarterly Dividends—Our failure to pay quarterly dividends to our common shareholders could cause the market

price of our common shares to decline significantly.

•

the sale of our common shares held by New SAC, members of our sponsor group or members of management.

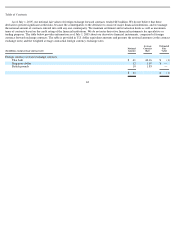

We paid quarterly dividends of $0.06 per share on each of August 20, 2004, November 19, 2004 and February 18, 2005 to our common

shareholders of record as of August 6, 2004, November 5, 2004 and February 4, 2005, respectively. On March 4, 2005, our board of directors

approved the increase of our quarterly dividend from $0.06 per share to no more than $0.08 per share. We paid a quarterly dividend of $0.08

per share on May 20, 2005 to our common shareholders of record as of May 6, 2005. On July 19, 2005 we declared a dividend of $0.08 per

share to be paid on or before August 19, 2005 to our common shareholders of record as of August 5, 2005.

Our ability to pay quarterly dividends will be subject to, among other things, general business conditions within the disc drive industry,

our financial results, the impact of paying dividends on our credit ratings, and legal and contractual restrictions on the payment of dividends by

our subsidiaries to us or by us to our common shareholders, including restrictions imposed by the covenants contained in the indenture

governing our senior notes and the credit agreement governing our senior secured credit facilities. Any reduction or discontinuation of quarterly

dividends could cause the market price of our common shares to decline significantly. Moreover, in the event our payment of quarterly

dividends is reduced or discontinued, our failure or inability to resume paying dividends at historical levels could result in a persistently low

market valuation of our common shares.

Taxation of Distributions—U.S. shareholders may be subject to U.S. federal income tax on future distributions on our common

shares.

Because we did not have any current or accumulated earnings and profits for U.S. federal income tax purposes for our taxable year ended

July 1, 2005, distributions on our common shares during this period were treated as a return of capital rather than dividend income for U.S.

federal income tax purposes. There can be no assurance, however, that we will not have current or accumulated earnings and profits for U.S.

federal income tax purposes in future years. To the extent that we have current or accumulated earnings and profits for U.S. federal

58