Seagate 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

highly integrated approach to our business by designing and manufacturing a significant portion of the components we view as critical to our

products, such as read/write heads and recording media. We believe that our control of these key technologies, combined with our platform

design and manufacturing, enable us to achieve product performance, time-to-market leadership and manufacturing flexibility, which allows us

to respond to customers and market opportunities. Our technology ownership combined with our integrated design and manufacturing have

allowed us to effectively leverage our leadership in traditional computing markets into new, higher-growth markets with only incremental

product development and manufacturing costs.

Revenue in fiscal year 2005 of $7.6 billion was driven primarily by customer acceptance of our new products introduced in June 2004,

particularly in the consumer electronics market. These new products contributed approximately 53% of revenue in our fourth quarter of fiscal

year 2005.

•

Consumer —

In the fourth quarter of fiscal year 2005, with respect to unit volume shipments, we achieved a leadership position in the

consumer electronics market, the fastest growing segment in the disc drive industry. We shipped a total of 16.7 million disc drives in

fiscal year 2005 for applications that include digital video recorders, digital music players and gaming devices, an increase of 165%

from fiscal year 2004. During the fourth quarter of fiscal year 2005 we shipped a record 6.2 million disc drives for these applications,

an increase of 222% from the year-ago quarter and an increase of 49% from the immediately preceding quarter. In June 2005, we

announced new products that will be available in the coming months for a variety of consumer electronics applications, including an

8 GB 1-inch disc drive for hand-held devices, a low-cost 2.5-inch disc drive for digital video recorders and game consoles, a rugged

2.5

-

inch disc drive for automobiles and a

½

terabyte 3.5

-

inch disc drive for digital video recorders.

•

Mobile

— Our market share of mobile computing products increased every quarter during fiscal year 2005. Unit shipments for fiscal

year 2005 were 5.7 million units, an increase of 58% from fiscal year 2004. During the fourth quarter of fiscal year 2005 we shipped

2.0 million disc drives, an increase of 342% from the year-ago quarter and an increase of 15% from the immediately preceding

quarter. In June 2005 we announced two new products for this market, the Momentus 5400.3, our first 2.5-inch, 160 GB notebook

disc drive utilizing perpendicular recording technology, and the Momentus FDE, a notebook disc drive with hardware based

encryption technology designed to address concerns over notebook computer theft and data protection.

•

Enterprise

— We experienced four consecutive quarters of record shipments for enterprise applications in fiscal year 2005. We

shipped 13.5 million units in fiscal year 2005, an increase of 30% from fiscal year 2004. During the fourth quarter of fiscal year 2005

we shipped a record 3.7 million disc drives, an increase of 45% from the year-ago quarter and an increase of 8% from the

immediately preceding quarter.

Over the past several quarters, our dependency on the distribution channel has declined due to stabilization of supply/demand, active

distribution inventory management and increased OEM demand. We exited the June quarter with approximately 4.5 weeks of distribution

channel inventory, which we believe was at the low-

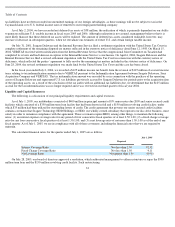

end of the industry average. For fiscal years 2005 and 2004, 72% and 64%, respectively, of

our disc drive revenue was from sales to OEMs. For the fourth quarter of fiscal year 2005, the third quarter of fiscal year 2005 and the fourth

quarter of fiscal year 2004, 76%, 70% and 74%, respectively, of our disc drive revenue was from sales to OEMs.

Historically, we have exhibited a seasonal decline in unit demand during the first half of each calendar year. Given the dramatic rates of

growth exhibited by the consumer electronics applications in the March 2005 and

25

•

Desktop

—In fiscal year 2005 we continued to lead the market with shipments of 62.2 million units, an increase of over 5% from

fiscal year 2004. Our product mix continued to improve as shipments of disc drives with capacities of 200 GB and larger in the June

2005 quarter were 37% more than those shipped in the March 2005 quarter. In June 2005 we expanded our offerings of high-

capacity

desktop disc drives with the announcement of a half-terabyte Barracuda disc drive for high-performance applications. We also

announced the Seagate External Hard Drive, a ½ terabyte, one-touch back-up external drive; and, the Portable External Drive, a

120GB, 2.5

-

inch external drive with Firewire connectivity.