Seagate 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

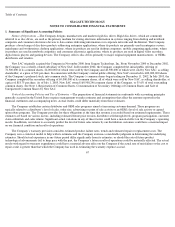

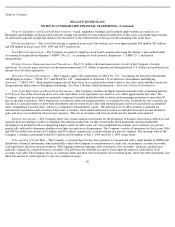

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

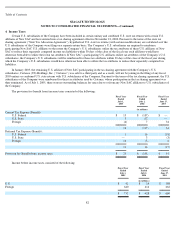

2. Balance Sheet Information

Financial Instruments

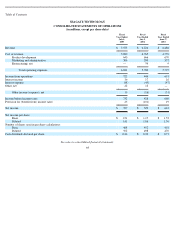

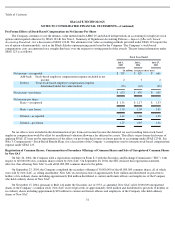

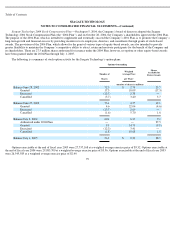

The following is a summary of the fair value of available-for-sale securities at July 1, 2005:

The following is a summary of the fair value of available-for-sale securities at July 2, 2004:

The fair value of the Company’s investment in debt securities, by remaining contractual maturity, is as follows:

Fair Value Disclosures —The carrying value of cash and cash equivalents approximates fair value. The fair values of short-term

investments, notes, marketable equity securities and debentures are estimated based on quoted market prices.

74

Amortized

Cost

Unrealized

Loss

Fair

Value

(in millions)

Money market mutual funds

$

58

$

—

$

58

U.S. government and agency obligations

539

(6

)

533

Auction rate preferred stock

434

—

434

Corporate securities

741

—

741

Total available

-

for

-

sale securities

$

1,772

$

(6

)

$

1,766

Included in cash and cash equivalents

$

676

Included in short

-

term investments

1,090

$

1,766

Amortized

Cost

Unrealized

Loss

Fair

Value

(in millions)

Money market mutual funds

$

60

$

—

$

60

U.S. government and agency obligations

401

(3

)

398

Auction rate preferred stock

304

—

304

Corporate securities

335

—

335

Total available

-

for

-

sale securities

$

1,100

$

(3

)

$

1,097

Included in cash and cash equivalents

$

336

Included in short

-

term investments

761

$

1,097

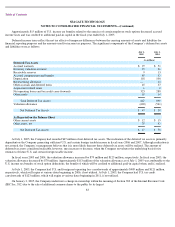

July 1,

2005

July 2,

2004

(in millions)

Due in less than 1 year

$

746

$

313

Due in 1 to 3 years

528

420

$

1,274

$

733