Neiman Marcus 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

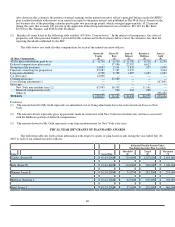

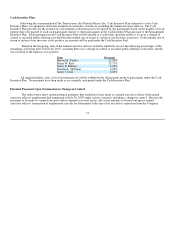

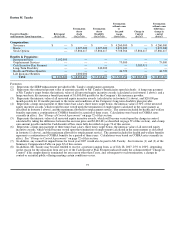

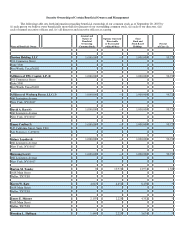

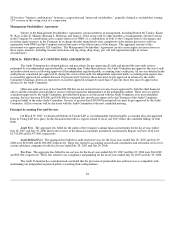

Burton M. Tansky

Executive Benefits

and Payments Upon Separation

Retirement

($)(1)(7)(8)

Termination

due to

death

($)(2)(7)(8)

Termination

due to

Disability

($)(3)(7)(8)

Termination

without cause

or

for good

reason

($)(4)(7)(8)

Change in

Control

($)(5)(7)

Termination

without cause

following a

change in

control

($)(6)(7)

Compensation:

Severance $ — $ — $ — $ 4,260,000 $ — $ 4,260,000

Bonus — 1,207,000 1,207,000 3,621,000 — 3,621,000

Stock Options — 15,886,417 15,886,417 9,708,366 15,886,417 15,886,417

Benefits & Perquisites:

Retirement Plans 3,192,000 — — — — —

Outplacement Services — — — 75,000 — 75,000

Cash Incentive Plan Payment — — — — 3,080,911 —

Long-Term Disability — — 240,000 — — —

Health and Welfare Benefits — — — 44,790 — 44,790

Life Insurance Benefits — 1,000,000 — — — —

Total $ 3,192,000 $ 18,093,417 $ 17,333,417 $ 17,709,156 $ 18,967,328 $ 23,887,207

Footnotes:

(1) Represents the SERP enhancement provided in Mr. Tansky's employment agreement.

(2) Represents the estimated present value of amounts payable to Mr. Tansky's beneficiaries upon his death: A lump sum payment

of Mr. Tansky's target bonus; the intrinsic value of all unvested equity incentive awards (calculated as in footnote 1 above); and a

lump sum basic life insurance benefit payment of $1,000,000 payable by the Company's life insurance provider.

(3) Represents the intrinsic value of all unvested equity incentive awards (calculated as in footnote (1) above), and $20,000 per

month payable for 12 months pursuant to the terms and conditions of the Company's long-term disability plan provider.

(4) Represents a lump sum payment of three times base salary, three times target bonus, the intrinsic value of 50% of the unvested

equity incentive awards, which would become vested upon the termination of employment (calculated in the same manner as

described in footnote 1 above), and the maximum allowed for outplacement service. The amount included for health and welfare

benefits represents a continuation of COBRA benefits for a period of three years. Calculations were based on COBRA rates

currently in effect. See "Change of Control Agreements" on page 72 of this section.

(5) Represents the intrinsic value of all unvested equity incentive awards, which will become vested upon the change in control,

calculated by taking the difference between the exercise price and $2,683.68 (as described on page 59 of this section), and a lump

sum amount payable under the Cash Incentive Plan, more fully described on page 74 of this section.

(6) Represents a lump sum payment of three times base salary, three times target bonus, the intrinsic value of all unvested equity

incentive awards, which would become vested upon the termination of employment (calculated in the same manner as described

in footnote (1) above), and the maximum allowed for outplacement service. The amount included for health and welfare benefits

represents a continuation of COBRA benefits for a period of three years. Calculations were based on COBRA rates currently in

effect. See "Change in Control Agreements" on page 72 of this section.

(7) In addition, any earned but unpaid bonus for fiscal year 2007 would also be paid to Mr. Tansky. See footnotes (1) and (3) of the

Summary Compensation Table on page 65 of this section.

(8) In addition, Mr. Tansky may become entitled to receive a portion (ranging from, as of July 28, 2007, 25% to 100%, depending

on the reason for the separation from service) of the Cash Incentive Plan Payment indicated under the column entitled "Change in

Control" if his employment is terminated for any reason other than Cause, and, subsequent to such termination, a change in

control or an initial public offering meeting certain conditions occurs.

75