Neiman Marcus 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171

|

|

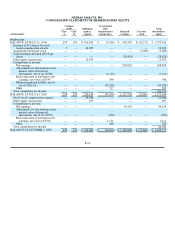

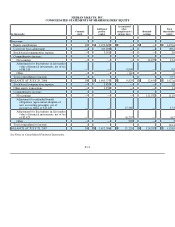

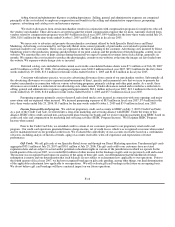

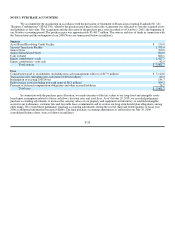

NEIMAN MARCUS, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in thousands)

Common

stock

Additional

paid-in

capital

Accumulated

other

comprehensive

income (loss)

Retained

earnings

Total

shareholders'

equity

Successor:

Equity contributions 10 $ 1,470,622 $ — $ — $ 1,470,632

Carryover basis adjustment — (69,200 ) — — (69,200

Stock based compensation expense — 3,951 — — 3,951

Comprehensive income:

Net earnings — — — 12,455 12,455

Adjustments for fluctuations in fair market

value of financial instruments, net of tax

of $6,510 — — 9,990 — 9,990

Other — — (161 ) — (161

Total comprehensive income 22,284

BALANCE AT JULY 29, 2006 10 $ 1,405,373 $ 9,829 $ 12,455 $ 1,427,667

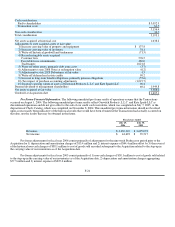

Stock based compensation expense — 5,859 — — 5,859

Other equity transactions — 1,154 — — 1,154

Comprehensive income:

Net earnings — — — 111,932 111,932

Adjustment for unfunded benefit

obligations (upon initial adoption of

new accounting principle), net of

income tax effect of $11,289 — — 17,365 — 17,365

Adjustments for fluctuations in fair market

value of financial instruments, net of tax

of $2,425 — — (6,257 ) — (6,257

Other — — 292 — 292

Total comprehensive income 123,332

BALANCE AT JULY 28, 2007 10 $ 1,412,386 $ 21,229 $ 124,387 $ 1,558,012

See Notes to Consolidated Financial Statements.

F-11