Neiman Marcus 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

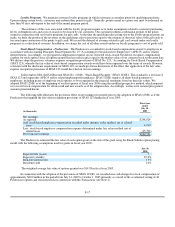

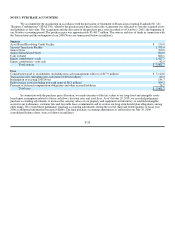

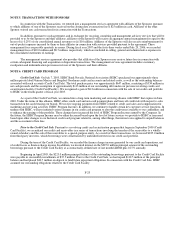

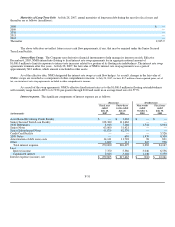

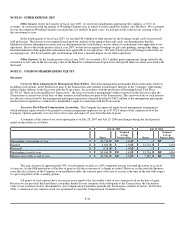

A summary of the income earned in connection with our proprietary credit card program is as follows:

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Income:

HSBC Program Income $ 65,723 $ 49,353 $ 7,818 $ 2,157

Finance charge income — — — 84,143

Expenses:

Bad debt, net — — — (14,656)

$ 65,723 $ 49,353 $ 7,818 $ 71,644

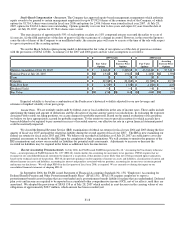

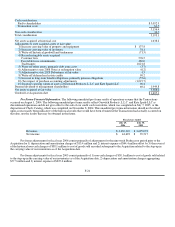

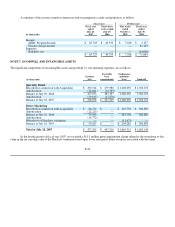

NOTE 7. GOODWILL AND INTANGIBLE ASSETS

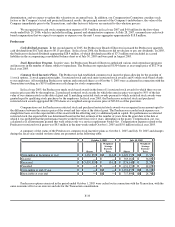

The significant components of our intangible assets and goodwill, by our operating segments, are as follows:

(in thousands)

Customer

lists

Favorable

lease

commitments

Tradenames

(indefinite

lives) Goodwill

Specialty Retail

Recorded in connection with Acquisition $ 490,314 $ 479,980 $ 1,406,030 $ 1,300,253

Amortization (32,641)(14,783)

Balance at July 29, 2006 457,673 465,197 1,406,030 1,300,253

Amortization (39,615)(17,878)

Balance at July 28, 2007 $ 418,058 $ 447,319 $ 1,406,030 $ 1,300,253

Direct Marketing

Recorded in connection with Acquisition $ 86,174 $ — $ 215,758 $ 304,887

Amortization (12,215)—

Balance at July 29, 2006 73,959 — 215,758 304,887

Amortization (14,772) —

Writedown of Horchow tradename — — (11,473)—

Balance at July 28, 2007 $ 59,187 $ — $ 204,285 $ 304,887

Total at July 28, 2007 $ 477,245 $ 447,319 $ 1,610,315 $ 1,605,140

In the fourth quarter of fiscal year 2007, we recorded a $11.5 million pretax impairment charge related to the writedown to fair

value in the net carrying value of the Horchow tradename based upon lower anticipated future revenues associated with the brand.

F-24