Neiman Marcus 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

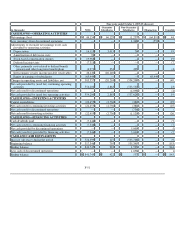

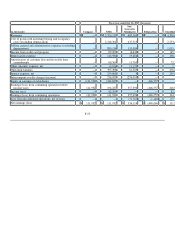

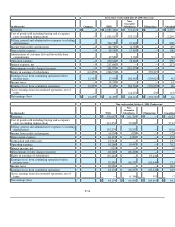

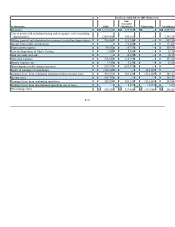

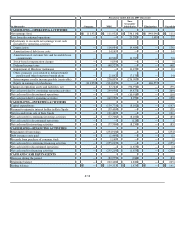

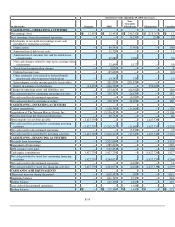

Nine weeks ended October 1, 2005 (Predecessor)

(in thousands) NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS—OPERATING ACTIVITIES

Net earnings (loss) $ 44,154 $ 64,891 $ (64,891 ) $ 44,154

Loss (earnings) from discontinued operations — 1,346 (553 ) 793

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation 16,118 3,091 — 19,209

Amortization of debt issue costs 96 — — 96

Stock-based compensation charges 19,968 — — 19,968

Deferred income taxes (7,318 ) — — (7,318

Other, primarily costs related to defined benefit pension and other

long-term benefit plans (4,971 ) 747 — (4,224

Intercompany royalty income payable (receivable) 46,240 (46,240 ) — —

Equity in earnings of subsidiaries (65,444 ) — 65,444 —

Changes in operating assets and liabilities, net 505,357 (554,502 )— (49,145

Net cash provided by (used for) continuing operating activities 554,200 (530,667 ) — 23,533

Net cash used for discontinued operations — (4,098 )— (4,098

Net cash provided by (used for) operating activities 554,200 (534,765 )— 19,435

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (22,455 )(3,120 )— (25,575

Net cash used for continuing investing activities (22,455 ) (3,120 ) — (25,575

Net cash used for discontinued operations — (736 )— (736

Net cash used for investing activities (22,455 )(3,856 )— (26,311

CASH FLOWS—FINANCING ACTIVITIES

Cash dividends paid (7,346 )— — (7,346

Net cash used for continuing financing activities (7,346 ) — — (7,346

Net cash provided by discontinued operations — 5,000 — 5,000

Net cash (used for) provided by financing activities (7,346 ) 5,000 — (2,346

CASH AND CASH EQUIVALENTS

Increase (decrease) during the period 524,399 (533,621 ) — (9,222

Beginning balance 317,346 536,136 — 853,482

Ending balance 841,745 2,515 — 844,260

Less cash of discontinued operations — 1,056 — 1,056

Ending balance $ 841,745 $ 1,459 $ — $ 843,204

F-60