Neiman Marcus 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with purchase accounting adjustments, we recorded liabilities for the unfunded status of our Pension Plan, SERP

Plan and Postretirement Plan as of the Acquisition date. These aggregate adjustments resulted in a net increase in the carrying values of

the Predecessor obligations previously recorded pursuant to generally accepted accounting principles by approximately $57.6 million.

We adopted the provisions of SFAS 158 in the fourth quarter of fiscal year 2007. SFAS 158 requires employers to report a

postretirement benefit asset for plans that are overfunded and a postretirement benefit liability for plans that are underfunded. Deferred

plan costs and income are required to be reported in accumulated other comprehensive income (OCI), net of tax effects, until they are

amortized. Such amounts will be adjusted as they are subsequently recognized as components of net periodic benefit cost or income

pursuant to the current recognition and amortization provisions.

In connection with the adoption of SFAS 158, we adjusted the carrying values of our previously recorded obligations to equal

their unfunded status at July 28, 2007. These aggregate adjustments resulted in a net decrease in the carrying values of our obligations by

approximately $28.7 million, which amount has been recorded (net of taxes of $11.3 million) as an increase in other comprehensive

income in our statement of shareholders' equity for fiscal year 2007.

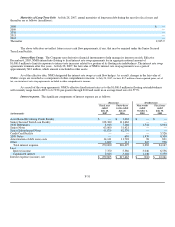

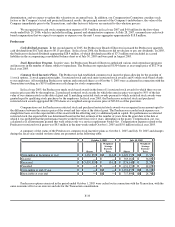

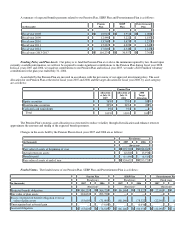

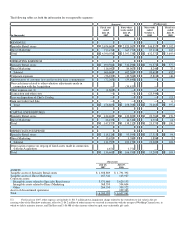

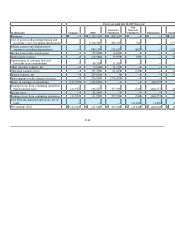

A rollforward of our recorded obligation for the Pension Plan, SERP Plan and Postretirement Plan from the Acquisition date to

July 28, 2007 is as follows:

(in thousands) Pension Plan SERP Plan

Postretirement

Plan

Predecessor obligations at Acquisition date $ 19,655 $ 63,540 $ 18,205

Net purchase accounting adjustments to record unfunded obligations at

Acquisition date 47,281 13,266 (2,924)

Unfunded obligations at Acquisition date 66,936 76,806 15,281

Expense 11,883 5,255 746

Benefits paid, net (1,703)(1,048)

Balance at July 29, 2006 78,819 80,358 14,979

Expense 13,642 6,647 779

Benefits paid, net (1,899) (831)

Adjustments for unfunded benefit obligations (upon initial adoption of new

accounting principle) (36,858)1,040 7,164

Balance at July 28, 2007 55,603 86,146 22,091

Less: current portion — (2,951)(1,068)

Long-term portion of benefit obligations $ 55,603 $ 83,195 $ 21,023

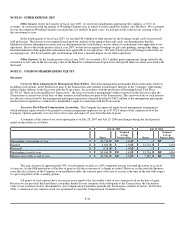

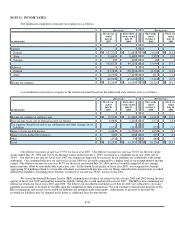

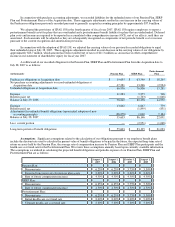

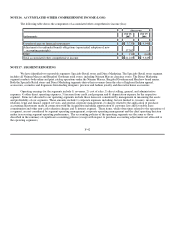

Assumptions. Significant assumptions related to the calculation of our obligations pursuant to our employee benefit plans

include the discount rate used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate of

return on assets held by the Pension Plan, the average rate of compensation increase by Pension Plan and SERP Plan participants and the

health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available information.

The assumptions we utilized in calculating the projected benefit obligations and periodic expense of our Pension Plan, SERP Plan and

Postretirement Plan are as follows:

August 1,

2007

August 1,

2006

October 1,

2005

August 1,

2005

Pension Plan:

Discount rate 6.25% 6.25% 5.75% 5.50%

Expected long-term rate of return on plan assets 8.00% 8.00% 8.00% 8.00%

Rate of future compensation increase 4.50% 4.50% 4.50% 4.50%

SERP Plan:

Discount rate 6.25% 6.25% 5.75% 5.50%

Rate of future compensation increase 4.50% 4.50% 4.50% 4.50%

Postretirement Plan:

Discount rate 6.25% 6.25% 5.75% 5.50%

Initial health care cost trend rate 8.00% 8.00% 8.00% 9.00%

Ultimate health care cost trend rate 8.00% 5.00% 5.00% 5.00%