Neiman Marcus 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in floating rate indebtedness

will currently range from 6.482% to 6.733% per quarter through 2010 and result in an average fixed rate of 6.577%.

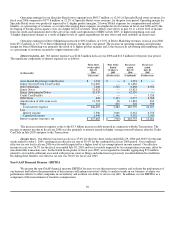

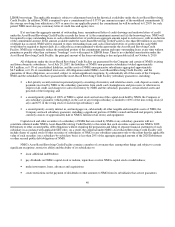

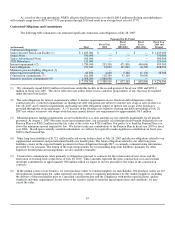

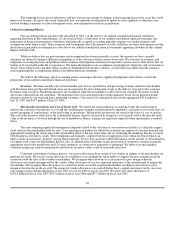

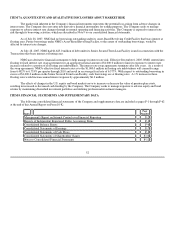

Contractual Obligations and Commitments

The following table summarizes our estimated significant contractual cash obligations at July 28, 2007:

Payments Due By Period

(in thousands) Total

Fiscal Year

2008

Fiscal

Years

2009-2010

Fiscal

Years

2011-2012

Fiscal Year

2013 and

Beyond

Contractual obligations:

Senior Secured Term Loan Facility (1) $ 1,625,000 $ — $ — $ — $ 1,625,000

Senior Notes 700,000 — — — 700,000

Senior Subordinated Notes 500,000 — — — 500,000

2028 Debentures 125,000 — — — 125,000

Interest requirements (2) 1,780,900 235,200 471,800 484,600 589,300

Lease obligations 951,300 54,000 101,900 96,500 698,900

Minimum pension funding obligation (3) — — — — —

Other long-term liabilities (4) 62,800 4,100 9,300 11,100 38,300

Construction commitments (5) 261,000 118,300 92,100 50,600 —

Inventory purchase commitments (6) 1,068,500 1,068,500 — — —

$ 7,074,500 $ 1,480,100 $ 675,100 $ 642,800 $ 4,276,500

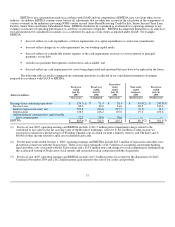

(1) We voluntarily repaid $100.0 million of term loans under this facility in the second quarter of fiscal year 2006 and $250.0

million in fiscal year 2007. The above table does not reflect future excess cash flow prepayments, if any, that may be required

under the term loan facility.

(2) The cash obligations for interest requirements reflect 1) interest requirements on our fixed-rate debt obligations at their

contractual rates, 2) interest requirements on floating rate debt obligations not subject to interest rate swaps at rates in effect at

July 28, 2007 and 3) interest requirements on floating rate debt obligations subject to interest rate swaps at the fixed rates

provided through the swap agreements. A 1% increase in the floating rates related to floating rate debt outstanding at July 28,

2007 not subject to interest rate swaps would increase annual interest rate requirements by approximately $6.3 million.

(3) Minimum pension funding requirements are not included above as such amounts are not currently quantifiable for all periods

presented. At August 1, 2007 (the most recent measurement date), our actuarially calculated projected benefit obligation for our

Pension Plan was $380.2 million and the fair value of the assets was $324.6 million. Our policy is to fund the Pension Plan at or

above the minimum amount required by law. We did not make any contributions to the Pension Plan in fiscal year 2007 or fiscal

year 2006. Based upon currently available information, we will not be required to make significant contributions in fiscal year

2008 to the Pension Plan.

(4) Other long-term liabilities of $172.1 million reflected on our balance sheet at July 28, 2007 include our obligations related to our

supplemental retirement and postretirement health care benefit plans. The future obligations related to our other long-term

liabilities consist of the expected benefit payments for these obligations through 2015, as currently estimated using information

provided by our actuaries. The timing of the expected payments for our remaining long-term liabilities, primarily for other

employee benefit plans and arrangements, are not currently estimable.

(5) Construction commitments relate primarily to obligations pursuant to contracts for the construction of new stores and the

renovation of existing stores expected as of July 28, 2007. These amounts represent the gross construction costs and exclude

developer contributions of approximately $36 million which we expect to receive pursuant to the terms of the construction

contracts.

(6) In the normal course of our business, we issue purchase orders to vendors/suppliers for merchandise. Our purchase orders are not

unconditional commitments but, rather represent executory contracts requiring performance by the vendors/suppliers, including

the delivery of the merchandise prior to a specified cancellation date and the compliance with product specifications, quality

standards and other requirements. In the event of the vendor's failure to meet the agreed upon terms and conditions, we may

cancel the order.

45