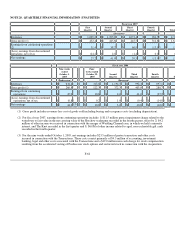

Neiman Marcus 2006 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

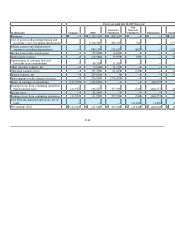

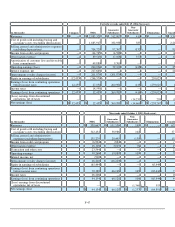

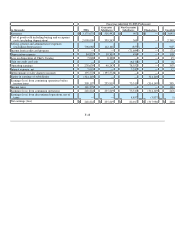

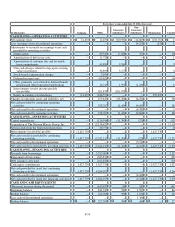

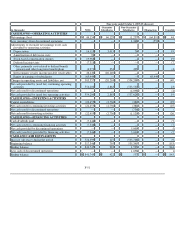

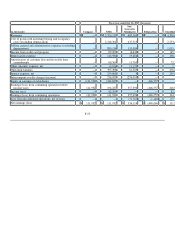

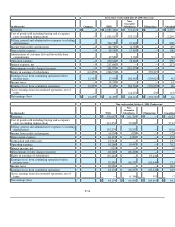

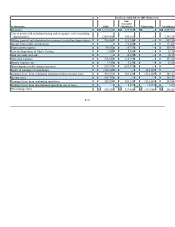

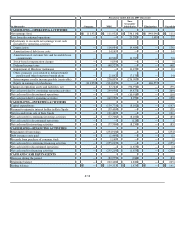

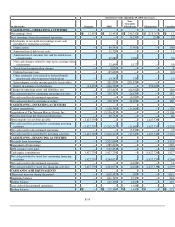

Fiscal year ended July 30, 2005 (Predecessor)

(in thousands) NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS - OPERATING ACTIVITIES

Net earnings (loss) $ 248,824 $ 235,819 $ 82,167 $ (317,986 ) $ 248,824

(Earnings) loss from discontinued operations — — (8,857 ) 3,837 (5,020

Adjustments to reconcile net earnings to net cashprovided by

operating activities:

Depreciation 84,832 18,301 456 — 103,589

Deferred income taxes (15,925 ) — — — (15,925

Loss on disposition of Chef's catalog 7,048 8,300 — — 15,348

Gain on Credit Card Sale — — (6,170 ) — (6,170

Net cash received from Credit Card Sale — — 533,656 — 533,656

Other, primarily costs related to defined benefit pension and

other long-term benefit plans 40,783 1,474 642 — 42,899

Intercompany royalty income payable (receivable) 195,572 (195,572 ) — —

Equity in earnings of subsidiaries (314,149 ) — — 314,149

Changes in operating assets and liabilities, net (119,816 )(51,468 )85,981 — (85,303

Net cash provided by continuing operating activities 127,169 16,854 687,875 — 831,898

Net cash provided by discontinued operations — — 13,502 — 13,502

Net cash provided by operating activities 127,169 16,854 701,377 — 845,400

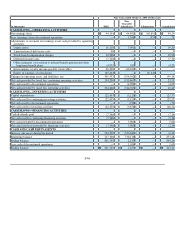

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (172,806 ) (16,887 ) (562 ) — (190,255

Net increase in cash restricted for repayment of borrowings under

Credit Card Facility — — (40,713 ) — (40,713

Proceeds from the sale of Chef's Catalog 14,419 — — — 14,419

Net cash used for continuing investing activities (158,387 ) (16,887 ) (41,275 ) — (216,549

Net cash used for discontinued operations — — (12,280 )— (12,280

Net cash used for investing activities (158,387 )(16,887 )(53,555 )— (228,829

CASH FLOWS—FINANCING ACTIVITIES

Repayment of borrowings on lines of credit (113 ) — — — (113

Repayment of borrowings under Credit Card Facility — — (112,500 ) — (112,500

Acquisitions of treasury stock (3,088 ) — — — (3,088

Proceeds from stock-based compensation awards 16,100 — — — 16,100

Cash dividends paid (27,398 )— — — (27,398

Net cash used for continuing financing activities (14,499 ) — (112,500 ) — (126,999

Net cash used for discontinued operations — — (4,457 )— (4,457

Net cash used for financing activities (14,499 )— (116,957 )— (131,456

CASH AND CASH EQUIVALENTS

(Decrease) increase during the period (45,717 ) (33 ) 530,865 — 485,115

Beginning balance 363,063 828 4,476 — 368,367

Ending balance 317,346 795 535,341 — 853,482

Less cash of discontinued operations — — 889 — 889

Ending balance $ 317,346 $ 795 $ 534,452 $ — $ 852,593

F-52