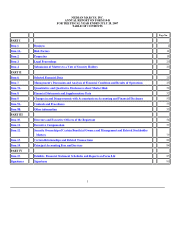

Neiman Marcus 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Seasonality

Our business, like that of most retailers, is affected by seasonal fluctuations in customer demand, product offerings and working

capital expenditures. For additional information on seasonality, see Item 7, "Management's Discussion and Analysis of Financial

Condition and Results of Operations—Executive Overview—Seasonality."

Regulation

The credit card operations that are conducted under our arrangements with HSBC are subject to numerous federal and state laws

that impose disclosure and other requirements upon the origination, servicing and enforcement of credit accounts and limitations on the

maximum amount of finance charges that may be charged by a credit provider. HSBC is subject to regulations to which we were not

subject prior to the Credit Card Sale. In addition to our proprietary credit cards, credit to our customers is also provided primarily through

third parties. Any effect of these regulations or change in the regulation of credit arrangements that would materially limit the availability

of credit to our customer base could adversely affect our results of operations or financial condition.

Our practices, as well as our competitors, are subject to review in the ordinary course of business by the Federal Trade

Commission and are subject to numerous federal and state laws. Additionally, we are subject to certain customs, truth-in-advertising and

other laws, including consumer protection regulations that regulate retailers generally and/or govern the importation, promotion and sale

of merchandise. We undertake to monitor changes in these laws and believe that we are in material compliance with all applicable state

and federal regulations with respect to such practices.

ITEM 1A. RISK FACTORS

Risks Related to Our Structure and NMG's Indebtedness

Because our ownership of NMG accounts for substantially all of our assets and operations, we are subject to all risks applicable

to NMG.

We are a holding company. NMG and its subsidiaries conduct substantially all of our consolidated operations and own

substantially all of our consolidated assets. As a result, we are subject to all risks applicable to NMG. In addition, NMG's Asset-Based

Revolving Credit Facility, NMG's Senior Secured Term Loan Facility and the indentures governing NMG's senior notes and senior

subordinated notes contain provisions limiting NMG's ability to distribute earnings to us, in the form of dividends or otherwise.

NMG has a substantial amount of indebtedness, which may adversely affect NMG's cash flow and its ability to operate the

business, to comply with debt covenants and make payments on its indebtedness.

As a result of the Transactions, we are highly leveraged. As of July 28, 2007, the principal amount of NMG's total indebtedness

was approximately $2,955.3 million and the unused borrowing availability under the $600 million Asset-Based Revolving Credit Facility

was approximately $573.1 million after giving effect to $26.9 million of letters of credit outstanding thereunder. NMG's substantial

indebtedness, combined with its lease and other financial obligations and contractual commitments, could have other important

consequences. For example, it could:

• make it more difficult for NMG to satisfy its obligations with respect to its indebtedness and any failure to comply with the

obligations of any of its debt instruments, including restrictive covenants and borrowing conditions, could result in an event

of default under the agreements governing NMG's indebtedness;

• make NMG more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse

changes in government regulation;

• require NMG to dedicate a substantial portion of its cash flow from operations to payments on its indebtedness, thereby

reducing the availability of cash flows to fund working capital, capital expenditures, acquisitions and other general

corporate purposes;

• limit NMG's flexibility in planning for, or reacting to, changes in NMG's business and the industry in which it operates;

11