Neiman Marcus 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

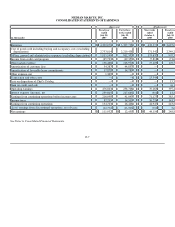

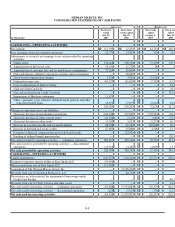

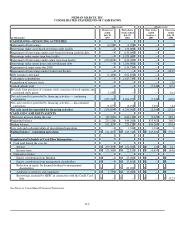

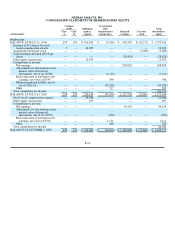

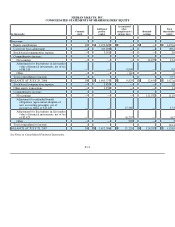

NEIMAN MARCUS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

On April 22, 2005, Neiman Marcus, Inc., formerly Newton Acquisition, Inc. (the Company), and its wholly-owned subsidiary,

Newton Acquisition Merger Sub, Inc. (Merger Sub), were formed and incorporated in the state of Delaware. On April 29, 2005, the

Company received subscriptions for 900 shares of its common stock from Newton Holding, LLC (Holding) in exchange for a capital

contribution of $900 and Merger Sub issued 900 shares of its common stock to the Company in exchange for a capital contribution of

$900. Holding, the Company and Merger Sub were formed by investment funds affiliated with TPG Capital (formerly Texas Pacific

Group) and Warburg Pincus LLC (collectively, the Sponsors) for the purpose of acquiring The Neiman Marcus Group, Inc. (NMG). The

equity subscriptions were subsequently funded by the Sponsors.

The acquisition of NMG was completed on October 6, 2005 through the merger of Merger Sub with and into NMG, with NMG

being the surviving entity (the Acquisition). Subsequent to the Acquisition, NMG is a subsidiary of the Company, which is controlled by

Holding. The Acquisition was recorded as of October 1, 2005, the beginning of our October accounting period.

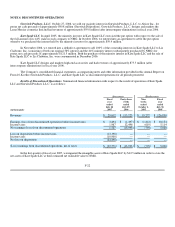

In connection with the acquisition of NMG, Holding made an aggregate cash equity contribution of $1,420.0 million and a

noncash equity contribution of $25.0 million to the Company in exchange for the Company issuing 999,100 shares of its common stock

to Holding. In addition, certain members of executive management of the Company made cash equity contributions aggregating

$7.7 million and noncash equity contributions, consisting of shares of common stock and common stock options in NMG, aggregating

$17.9 million in exchange for 12,264 shares of common stock in the Company.

Prior to the Acquisition, the Company had no independent assets or operations. After the Acquisition, the Company represents

the Successor to NMG since the Company's sole asset is its investment in NMG and its operations consist solely of the operating

activities of NMG as well as costs incurred by the Company related to its investment in NMG. For periods prior to the Acquisition, NMG

is deemed to be the predecessor to the Company. As a result, for periods prior to the Transactions, the financial statements of the

Company consist of the financial statements of NMG for such periods. The accompanying consolidated statements of earnings and cash

flows present our results of operations and cash flows for the periods preceding the Acquisition (Predecessor) and the periods succeeding

the Acquisition (Successor), respectively. All references to "we" and "our" relate to the Company for periods subsequent to the

Transactions and to NMG for periods prior to the Transactions.

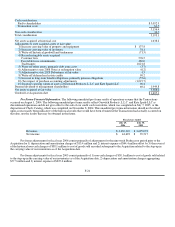

Our fiscal year ends on the Saturday closest to July 31. All references to fiscal year 2007 relate to the 52 weeks ended July 28,

2007; all references to fiscal year 2006 relate to the combined period comprised of forty-three weeks ended July 29, 2006 (Successor) and

the nine weeks ended October 1, 2005 (Predecessor) and all references to fiscal year 2005 relate to the 52 weeks ended July 30, 2005.

F-12