Neiman Marcus 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

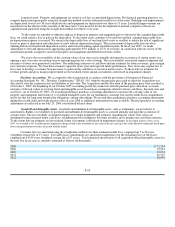

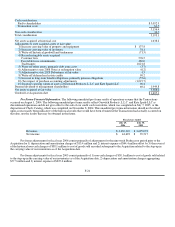

Stock-Based Compensation - Successor. The Company has approved equity-based management arrangements which authorize

equity awards to be granted to certain management employees for up to 87,992.0 shares of the common stock of the Company, of which

options for 81,716.3 shares were issued in fiscal year 2006 and options for 2,496.0 shares were issued in fiscal year 2007. At July 28,

2007, options for 83,634.3 shares were outstanding. Options generally vest over four to five years and expire 10 years from the date of

grant. At July 28, 2007, options for 29,764.1 shares were vested.

The exercise price of approximately 50% of such options escalate at a 10% compound rate per year until the earlier to occur of

(i) exercise, (ii) the fifth anniversary of the date of grant or (iii) the occurrence of a change in control. However, in the event the Sponsors

cause the sale of shares of the Company to an unaffiliated entity, the exercise price will cease to accrete at the time of the sale with respect

to a pro rata portion of the accreting options.

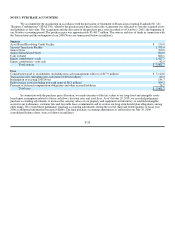

We use the Black-Scholes option-pricing model to determine the fair value of our options as of the date of grant in accordance

with the provisions of SFAS 123(R). A summary of the 2007 and 2006 grants and fair value assumptions is as follows:

2007 Grants 2006 Grants

Fair Value

Options

Accreting

Exercise Price

Options

Fair Value

Options

Accreting

Exercise Price

Options

Options outstanding at July 28, 2007 1,248.0 1,248.0 43,594.6 37,543.7

Exercise Price at July 28, 2007 $ 1,942 $ 1,942 $ 1,445 $ 1,590

Term 5 5 5 5

Volatility 29.96 % 29.96 % 29.72 % 29.72 %

Risk-Free Rate 4.53 % 4.53 % 4.23 % 4.23 %

Dividend Yield — — — —

Fair Value $ 676 $ 341 $ 494 $ 247

Expected volatility is based on a combination of the Predecessor's historical volatility adjusted for our new leverage and

estimates of implied volatility of our peer group.

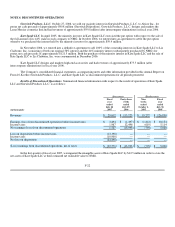

Income Taxes. We are routinely under audit by federal, state or local authorities in the area of income taxes. These audits include

questioning the timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating the exposure

associated with various tax filing positions, we accrue charges for probable exposures. Based on our annual evaluations of tax positions,

we believe we have appropriately accrued for probable exposures. To the extent we were to prevail in matters for which accruals have

been established or be required to pay amounts in excess of recorded reserves, our effective tax rate in a given financial statement period

could be materially impacted.

We closed the Internal Revenue Service (IRS) examinations of federal tax returns for fiscal years 2004 and 2003 during the first

quarter of fiscal year 2007 and paid the related tax liability during the second quarter of fiscal year 2007. The IRS is now examining our

federal tax returns for fiscal years 2005 and 2006. We believe our recorded tax liabilities as of July 28, 2007 are sufficient to cover any

potential assessments to be made by the IRS upon the completion of their examinations. We will continue to monitor the progress of the

IRS examinations and review our recorded tax liabilities for potential audit assessments. Adjustments to increase or decrease the

recorded tax liabilities may be required in the future as additional facts become known.

Recent Accounting Pronouncements. In July 2006, the FASB issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income

Taxes – an interpretation of FASB Statement No. 109" (FIN 48), which clarifies the accounting for uncertainty in tax positions. FIN 48 requires that we

recognize in our consolidated financial statements the impact of a tax position, if that position is more likely than not of being sustained upon examination,

based on the technical merits of the position. FIN 48 also provides guidance on derecognition of income tax assets and liabilities, classification of current and

deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods

and income tax disclosures. We will adopt FIN 48 in the first quarter of fiscal year 2008, as required. We are currently evaluating the impact on our

consolidated financial statements of adopting FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, "Employers' Accounting for

Defined Benefit Pension and Other Postretirement Benefit Plans" (SFAS 158). SFAS 158 requires employers to report a

postretirement benefit asset for plans that are overfunded and a postretirement benefit liability for plans that are underfunded. Deferred

plan costs and income are required to be reported in accumulated other comprehensive income (OCI), net of tax effects, until they are

amortized. We adopted the provisions of SFAS 158 as of July 28, 2007 which resulted in a net decrease in the carrying values of our

obligations of approximately $28.7 million, which amount has been recorded (net

F-18