Neiman Marcus 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

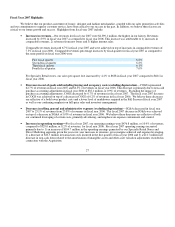

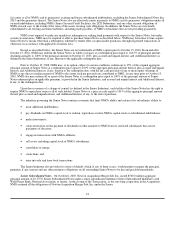

EBITDA is not a presentation made in accordance with GAAP and our computation of EBITDA may vary from others in our

industry. In addition, EBITDA contains some, but not all, adjustments that are taken into account in the calculation of the components of

various covenants in the indentures governing NMG's senior secured Asset-Based Revolving Credit Facility, Senior Secured Term Loan

Facility, Senior Notes and Senior Subordinated Notes. EBITDA should not be considered as an alternative to operating earnings or net

earnings as measures of operating performance or cash flows as measures of liquidity. EBITDA has important limitations as an analytical

tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. For example,

EBITDA:

• does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

• does not reflect changes in, or cash requirements for, our working capital needs;

• does not reflect our considerable interest expense, or the cash requirements necessary to service interest or principal

payments, on our debt;

• excludes tax payments that represent a reduction in cash available; and

• does not reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future.

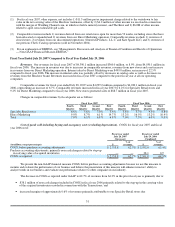

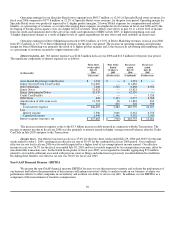

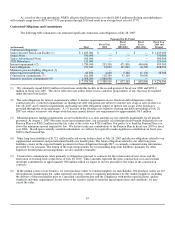

The following table reconciles earnings from continuing operations as reflected in our consolidated statements of earnings

prepared in accordance with GAAP to EBITDA:

(dollars in millions)

Fiscal year

ended

July 28,

2007

Fiscal year

ended

July 29,

2006

Forty-three

weeks

ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

(Successor) (Combined) (Successor) (Predecessor) (Predecessor)

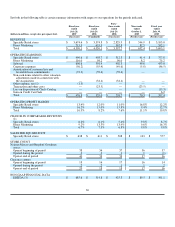

Earnings from continuing operations $ 134.7(1) $ 71.4 $ 26.4 $ 45.0(2) $ 243.8(3)

Income taxes 82.3 40.8 14.6 26.2 141.4

Interest expense (income), net 259.8 216.8 217.7 (0.9) 12.3

Depreciation 136.5 126.2 107.0 19.2 103.6

Amortization of customer lists and favorable

lease commitments 72.3 59.6 59.6 — —

EBITDA $ 685.6(1) $ 514.8 $ 425.3 $ 89.5(2) $ 501.1(3)

(1) For fiscal year 2007, operating earnings and EBITDA include 1) $11.5 million pretax impairment charge related to the

writedown to fair value in the net carrying value of the Horchow tradename, offset by 2) $4.2 million of other income we

received in connection with the merger of Wedding Channel.com, in which we held a minority interest, and The Knot and 3)

$6.0M of other income related to aged, non-escheatable gift cards.

(2) For the nine weeks ended October 1, 2005, operating earnings and EBITDA include $23.5 million of transaction and other costs

incurred in connection with the Transactions. These costs consist primarily of $4.5 million of accounting, investment banking,

legal and other costs associated with the Transactions and a $19.0 million non-cash charge for stock compensation resulting from

the accelerated vesting of Predecessor stock options and restricted stock in connection with the Acquisition.

(3) For fiscal year 2005, operating earnings and EBITDA include a $15.3 million pretax loss related to the disposition of Chef's

Catalog in November 2004 and a $6.2 million pretax gain related to the sale of our credit card portfolio.

37