Neiman Marcus 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

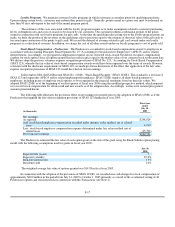

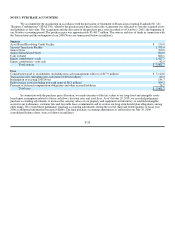

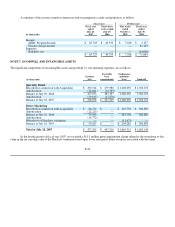

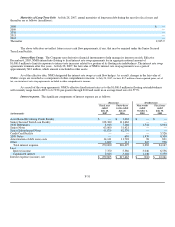

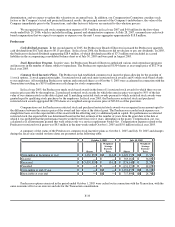

NOTE 8. ACCRUED LIABILITIES

The significant components of accrued liabilities are as follows:

(Successor)

July 28,

2007

July 29,

2006

Accrued salaries and related liabilities $ 79,021 $ 65,803

Amounts due customers 51,750 49,968

Self-insurance reserves 44,544 45,505

Sales returns reserves 48,819 43,742

Interest payable 35,146 40,337

Income taxes payable 30,052 32,745

Sales tax 23,429 21,556

Loyalty program liability 20,477 18,127

Other 69,924 60,185

Total $ 403,162 $ 377,968

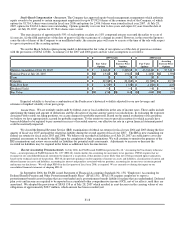

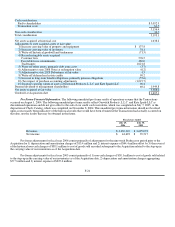

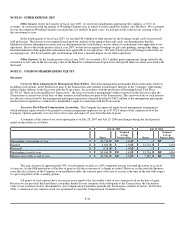

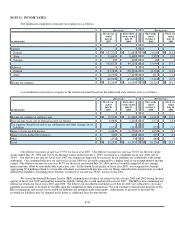

NOTE 9. LONG-TERM DEBT

The significant components of our long-term debt are as follows:

(Successor)

(in thousands) Interest Rate

July 28,

2007

July 29,

2006

Senior Secured Term Loan Facility variable $ 1,625,000 $ 1,875,000

2028 Debentures 7.125% 120,906 120,711

Senior Notes 9.0%/9.75% 700,000 700,000

Senior Subordinated Notes 10.375% 500,000 500,000

Long-term debt $ 2,945,906 $ 3,195,711

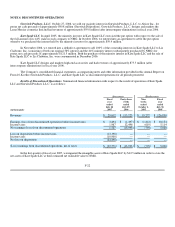

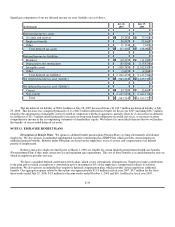

Senior Secured Asset-Based Revolving Credit Facility. On October 6, 2005, in connection with the Transactions, NMG

entered into a credit agreement and related security and other agreements for a senior secured Asset-Based Revolving Credit Facility with

Deutsche Bank Trust Company Americas as administrative agent and collateral agent. The Asset-Based Revolving Credit Facility

provides financing of up to $600.0 million, subject to a borrowing base equal to at any time the lesser of 80% of eligible inventory

(valued at the lower of cost or market value) and 85% of net orderly liquidation value of the eligible inventory, less certain reserves. The

Asset-Based Revolving Credit Facility includes borrowing capacity available for letters of credit and for borrowings on same-day notice.

At the closing of the Transactions, NMG utilized $150.0 million of the Asset-Based Revolving Credit Facility for loans and

approximately $16.5 million for letters of credit. In the second quarter of fiscal year 2006, NMG repaid all loans under the Asset-Based

Revolving Credit Facility.

As of July 28, 2007, NMG had $573.1 million of unused borrowing availability under the Asset-Based Revolving Credit Facility

based on a borrowing base of over $600.0 million and after giving effect to $26.9 million used for letters of credit.

The Asset-Based Revolving Credit Facility provides that NMG has the right at any time to request up to $200.0 million of

additional commitments, but the lenders are under no obligation to provide any such additional commitments, and any increase in

commitments will be subject to customary conditions precedent. If NMG were to request any such additional commitments and the

existing lenders or new lenders were to agree to provide such commitments, the Asset-Based Revolving Credit Facility size could be

increased to up to $800.0 million, but NMG's ability to borrow would still be limited by the amount of the borrowing base.

Borrowings under the Asset-Based Revolving Credit Facility bear interest at a rate per annum equal to, at NMG's option, either

(a) a base rate determined by reference to the higher of (1) the prime rate of Deutsche Bank Trust Company Americas and (2) the federal

funds effective rate plus 1¤2 of 1% or (b) a LIBOR rate, subject to certain adjustments, in each case

F-25