Neiman Marcus 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

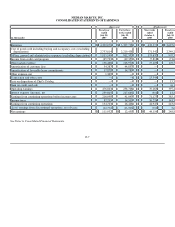

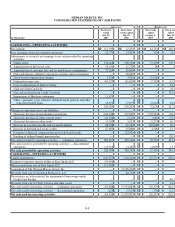

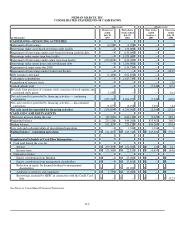

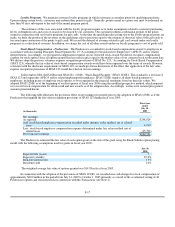

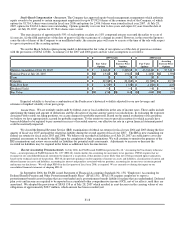

NEIMAN MARCUS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

CASH FLOWS—FINANCING ACTIVITIES

Repayment of borrowings (4,918 ) (1,078 ) — (113

Borrowings under asset-based revolving credit facility — 150,000 — —

Repayment of borrowings under asset-based revolving credit facility — (150,000 ) — —

Borrowings under senior term loan facility — 1,975,000 — —

Repayment of borrowings under senior term loan facility (250,000 ) (100,000 ) — —

Borrowings under senior notes and subordinated debt — 1,200,000 — —

Repayment of senior notes due 2008 — (134,734 ) — —

Repayment of borrowings under Credit Card Facility — — — (112,500

Debt issuance costs paid (1,449 ) (102,854 ) — —

Cash equity contributions — 1,427,739 — —

Acquisition of treasury stock — — — (3,088

Cash dividends paid — — (7,346 ) (27,398

Proceeds from purchase of common stock, exercises of stock options and

restricted stock grants 1,148 — — 16,100

Net cash (used for) provided by financing activities — continuing

operations (255,219 ) 4,264,073 (7,346 ) (126,999

Net cash (used for) provided by financing activities — discontinued

operations (1,675 )(4,168 ) 5,000 (4,457

Net cash (used for) provided by financing activities (256,894 )4,259,905 (2,346 )(131,456

CASH AND CASH EQUIVALENTS

(Decrease) increase during the year (83,921 ) (619,132 ) (9,222 ) 485,115

Beginning balance 225,128 844,260 853,482 368,367

Ending balance 141,207 225,128 844,260 853,482

Less cash and cash equivalents of discontinued operations — 1,388 1,056 889

Ending balance - continuing operations $ 141,207 $ 223,740 $ 843,204 $ 852,593

Supplemental Schedule of Cash Flow Information:

Cash paid during the year for:

Interest $ 259,709 $ 181,022 $ 134 $ 22,717

Income taxes $ 155,568 $ 22,815 $ 10,693 $ 144,626

Noncash activities:

Equity contribution from Holding $ — $ 25,000 $ — $ —

Equity contribution from management shareholders $ — $ 17,891 $ — $ —

Reduction in equity for deemed dividend to management

shareholders $ — $ 69,200 $ — $ —

Additions to property and equipment $ 1,733 $ 15,085 $ — $ —

Borrowings assumed by HSBC in connection with the Credit Card

Sale $ — $ — $ — $ 112,500

See Notes to Consolidated Financial Statements.

F-9