Neiman Marcus 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Loyalty Programs. We maintain customer loyalty programs in which customers accumulate points for qualifying purchases.

Upon reaching certain levels, customers may redeem their points for gifts. Generally, points earned in a given year must be redeemed no

later than 90 days subsequent to the end of the annual program period.

The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing

levels, redemption rates and costs of awards to be chosen by our customers. Our customers redeem a substantial portion of the points

earned in connection with our loyalty programs for gift cards. At the time the qualifying sales giving rise to the loyalty program points are

made, we defer the portion of the revenues on the qualifying sales transactions equal to the estimate of the retail value of the gift cards to

be issued upon conversion of the points to gift cards. We record the deferral of revenues related to gift card awards under our loyalty

programs as a reduction of revenues. In addition, we charge the cost of all other awards under our loyalty programs to cost of goods sold.

Stock-Based Compensation - Predecessor. The Predecessor accounted for stock-based compensation awards to employees in

accordance with Accounting Principles Board Opinion No. 25 "Accounting for Stock Issued to Employees" (APB 25) and its related

interpretations. Accordingly, we recognized compensation expense on our restricted stock awards but did not recognize compensation

expense for stock options since all options granted had an exercise price equal to the market value of our common stock on the grant date.

We did not adopt the previous voluntary expense recognition provisions of SFAS No. 123, "Accounting for Stock-Based Compensation"

(SFAS 123), whereby the fair value of stock-based compensation awards would have been expensed over the terms of awards. However,

consistent with the disclosure requirements of SFAS 123, we made pro forma disclosures of the effect that application of the fair value

expense recognition provisions of SFAS 123 would have had on our net earnings.

In December 2004, the FASB issued SFAS No. 123(R), "Share-Based Payment" (SFAS 123(R)). This standard is a revision of

SFAS 123 and supersedes APB 25 and its related implementation guidance. SFAS 123(R) requires all share-based payments to

employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. We

adopted SFAS 123(R) as of the beginning of our first quarter of fiscal year 2006 using the modified prospective method, which required

us to record stock compensation for all unvested and new awards as of the adoption date. Accordingly, we have not restated prior period

amounts presented herein.

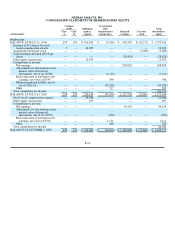

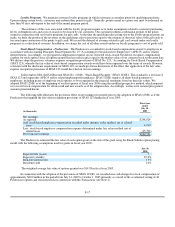

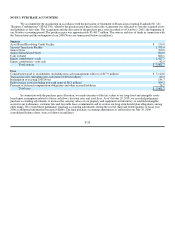

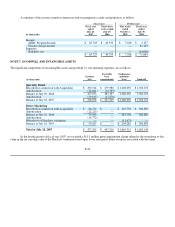

The following table illustrates the pro forma effect on net earnings for periods prior to the adoption of SFAS 123(R) as if the

Predecessor had applied the fair value recognition provisions of SFAS 123 during fiscal year 2005:

(in thousands)

Fiscal year

ended

July 30,

2005

Net earnings:

As reported $248,824

Add: stock-based employee compensation recorded under intrinsic value method, net of related

taxes 4,999

Less: stock-based employee compensation expense determined under fair value method, net of

related taxes (13,302)

Pro forma net earnings $240,521

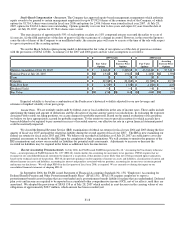

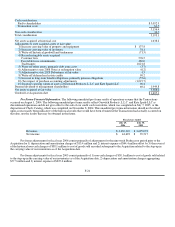

The Predecessor estimated the fair value of each option grant on the date of the grant using the Black-Scholes option pricing

model with the following assumptions used for grants in fiscal year 2005:

July 30,

2005

Expected life (years) 5

Expected volatility 25.0%

Risk-free interest rate 3.3%

Dividend yield 1.0%

The weighted-average fair value of options granted was $14.38 in fiscal year 2005.

In connection with the adoption of the provisions of SFAS 123(R), we recorded non-cash charges for stock compensation of

approximately $20.0 million in the period from July 31, 2005 to October 1, 2005 primarily as a result of the accelerated vesting of all

Predecessor options and restricted stock in connection with the Transactions (see Note 2).

F-17