Neiman Marcus 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

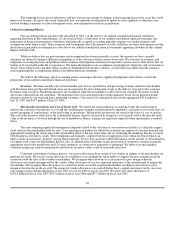

Recent Accounting Pronouncements

In July 2006, the FASB issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes — an

interpretation of FASB Statement No. 109" (FIN 48), which clarifies the accounting for uncertainty in tax positions. FIN 48 requires

that we recognize in our consolidated financial statements the impact of a tax position, if that position is more likely than not of being

sustained upon examination, based on the technical merits of the position. FIN 48 also provides guidance on derecognition of income

tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties

associated with tax positions, accounting for income taxes in interim periods and income tax disclosures. We will adopt FIN 48 in the

first quarter of fiscal year 2008, as required. We are currently evaluating the impact on our consolidated financial statements of

adopting FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, "Employers' Accounting for

Defined Benefit Pension and Other Postretirement Benefit Plans" (SFAS 158). SFAS 158 requires employers to report a

postretirement benefit asset for plans that are overfunded and a postretirement benefit liability for plans that are underfunded. Deferred

plan costs and income are required to be reported in accumulated other comprehensive income (OCI), net of tax effects, until they are

amortized. We adopted the provisions of SFAS 158 as of July 28, 2007 which resulted in a net decrease in the carrying values of our

obligations of approximately $28.7 million, which amount has been recorded (net of taxes of $11.3 million) as an increase in other

comprehensive income in our statement of shareholders' equity for fiscal year 2007. See Note 13 of the Notes to Consolidated

Financial Statements in Item 15.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses the process and diversity in practice of quantifying financial statement misstatements resulting in the potential build up

of improper amounts on the balance sheet. The provisions of SAB 108 became effective during the fourth quarter of fiscal year 2007

but had no impact on the Company's results of operations or financial position.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, "Fair Value Measurements"

(SFAS 157), which provides guidance for using fair value to measure certain assets and liabilities. SFAS 157 will apply whenever

another standard requires or permits assets or liabilities to be measured at fair value. The standard does not expand the use of fair

value to any new circumstances. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15,

2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the impact, if any, of adopting SFAS 157 on our

consolidated financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for

Financial Assets and Financial Liabilities" (SFAS 159). SFAS 159 expands opportunities to use fair value measurement in financial

reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. This Statement is

effective for fiscal years beginning after November 15, 2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the

impact, if any, of adopting SFAS 159 on our consolidated financial statements.

51