Neiman Marcus 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

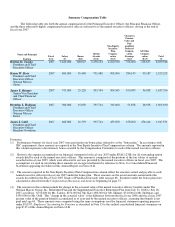

In addition, Mr. Tansky and Ms. Katz have employment agreements with the Company that contractually bind the Company,

among other things, from lowering their base salaries to a level below what they were paid when they first entered into their respective

employment agreement. During the term of the agreements, the annual salary for each of Mr. Tansky and Ms. Katz must be reviewed

annually and is subject to adjustment at the discretion of the Board. For a further description of these employment agreements, see

page 63 of this section.

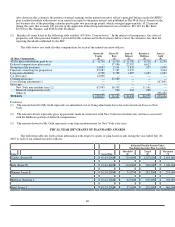

--- Annual Incentive Compensation

Annual bonus incentives keyed to short term objectives form the second building block of our compensation program and are

designed to provide incentives to achieve certain annual performance objectives and financial goals of the Company. These

performance objectives, which are used to determine annual bonus incentives for all employees, emphasize profitability and asset

management. The Compensation Committee believes that a significant portion of annual cash compensation for the named executive

officers should be at risk and tied to our operational and financial results. "Pay for performance" for the named executive officers has

been significantly enhanced in recent years by putting a larger part of their potential compensation at risk in the annual bonus

incentive program.

All named executive officers are eligible to be considered for annual bonus incentives. Target annual performance

incentives, stated as a percentage of base salary, are established for each of the named executive officers. The objectives set for Mr.

Tansky and other senior officers with broad corporate responsibilities are based on financial results of the overall company and

individual performance goals. When an employee has responsibility for a particular business unit or division, the performance goals

are heavily weighted toward the operational performance of that unit.

Actual awards earned by the named executive officers are determined based on an assessment of our overall performance

versus the annual objectives, a review of each named executive officer's contribution to our overall achievement and an assessment of

each named executive officer's performance versus their individual objectives. Mr. Tansky recommends bonus awards for other

named executive officers for the Committee's approval. The Committee recommends the bonus for Mr. Tansky to the full Board for

its approval.

The employment agreements of Mr. Tansky and Ms. Katz contain provisions regarding the payment of annual incentives.

The actual amounts will be determined according to the terms of the annual bonus program and will be payable at the discretion of the

Board of Directors. However, Mr. Tansky's employment agreement provides that if bonus levels for a fiscal year are met, the

minimum bonus amount he will receive will be 50% of his base salary. If the target bonus goal for the fiscal year is met, he will

receive 85% of his base salary, and if the maximum target goal is met, he will receive 170% of his base salary. Under the terms of

Ms. Katz' employment agreement, if the target goal set by the Compensation Committee for each fiscal year is met, the amount of Ms.

Katz' annual bonus can be adjusted but cannot be reduced below 65% of her base salary. See page 61 of this section for a more

detailed discussion of the minimum, target, and maximum bonus goals set by the Compensation Committee for fiscal year 2007.

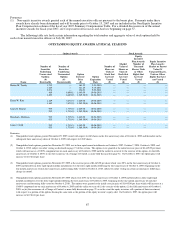

-- Long-Term Incentive

Long-term incentives in the form of stock options are intended to promote sustained high performance and to align our

executives' interests with those of our equity investors. The stock options, which vest over five years other than in the case of Mr.

Tansky whose options vest over four years, will only create value for the executives if the value of the Company increases. This

creates a direct correlation to the interests of our equity investors.

An initial stock option grant was made in fiscal year 2006 under the Neiman Marcus, Inc. Management Equity Incentive

Plan, referred to as the Management Incentive Plan, to each of the named executive officers. No grants of stock options were made to

the named executive officers in fiscal year 2007 and none are anticipated until the vesting period of the initial stock option grants has

lapsed, or in the event of a promotion or a new hire. The initial grant was made following the consummation of the Transactions in

order to retain the senior management team and to enable them to share in the growth of the Company along with our equity investors.

All grants of stock options under the Management Incentive Plan have an exercise price equal to the fair market value of our

common stock on the date of grant. Because our Company is privately held and there is no public market for our common stock, the

fair market value of our common stock subsequent to the Transactions is determined by our Compensation Committee periodically

based upon a number of factors. In April 2007, a valuation of our common stock was performed to assist the Compensation

Committee in this determination resulting in a valuation price of $2,683.68. We expect to update this valuation on an annual basis. In

addition, our Compensation Committee considers such factors as the Company's actual and projected financial results, the principal

amount of the Company's indebtedness, the value of the Company immediately prior to the Transaction,

59