Neiman Marcus 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and other factors it believes are material to the valuation process.

In addition, following the consummation of the Transactions, the Neiman Marcus, Inc. Cash Incentive Plan (referred to as the

Cash Incentive Plan) was adopted in 2005 to aid in the retention of certain key executives, including our named executive officers.

Under the Cash Incentive Plan, a $14 million cash bonus pool was created to be shared by its participants. In the event of a change in

control or an initial public offering in which the internal rate of return to our investors is positive, each participant in the Cash

Incentive Plan, subject generally to continued employment, will be entitled to a cash bonus based upon the number of options that

were granted to the participant relative to the other participants in the Cash Incentive Plan under the Management Incentive Plan. Mr.

Tansky will be entitled to receive (subject, with certain exceptions, to continued employment) a cash bonus under the Cash Incentive

Plan in the amount of $3,080,911 pursuant to the terms of his employment agreement. If the internal rate of return to the Sponsors is

not positive following a change in control or an initial public offering, no amounts will be paid to those participating in the Cash

Incentive Plan. No amounts have been paid to date under the Cash Incentive Plan.

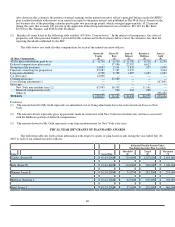

We believe the compensation objectives described earlier effectively and appropriately compensate our executives by guiding

their activities toward the achievement of targeted performance objectives, both short and long term. The amount of compensation,

both in individual elements and in the aggregate, is targeted between the 50th and 75th percentile levels of a peer group of industry

related companies.

Retirement, termination, and change in control benefits are also part of the compensation package for each named executive

officer. Our defined benefit and deferred compensation plans, as well as our change in control agreements and are described in more

detail below.

Compensation Actions for the Named Executive Officers in fiscal year 2007

--- Market Comparisons

The Compensation Committee requests information from its outside consultants to determine if any element of compensation

needs adjustment, including material change in order to comply with our strategy of targeting executive compensation that is between

the 50th and 75th percentile levels of the compensation packages received by executives at a group of industry related companies.

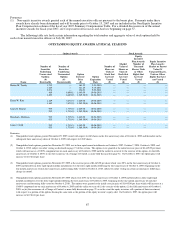

In fiscal year 2007, the Compensation Committee, on the recommendation of its compensation consultants, referred primarily

to the 16 companies identified below for purposes of benchmarking the compensation of our named executive officers. These

companies are intended to represent our competitors for business and talent. Their executive compensation programs are compared to

ours, as well as the compensation of individual executives if the jobs are sufficiently similar to make the comparison meaningful. The

comparison data is used to ensure that our named executive officer compensation, both individually and as a whole, is appropriately

competitive relative to our Company's performance.

Abercrombie & Fitch Liz Claiborne

Ann Taylor Nordstrom

Coach Polo Ralph Lauren

Macy's Saks

The Gap Talbots

Jones Apparel Tiffany & Co.

Kohl's Tommy Hilfiger

Limited Brands Williams Sonoma

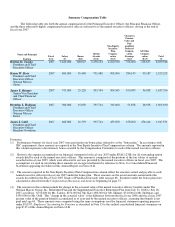

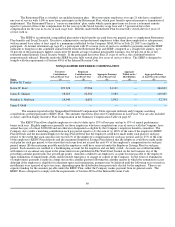

--- Base Salary

For fiscal year 2007, Mr. Tansky was awarded a 5.2% increase from $1,350,000 in fiscal year 2006 to $1,420,000 for fiscal

year 2007. Ms. Katz was also awarded a 5.3% merit increase from $760,000 to $800,000. Mr. Gold was awarded an 8.2% increase

from $425,000 to $460,000 due to the competitive market considerations of the New York metropolitan area. Mr. Hoffman was

awarded an 8.7% increase from $460,000 to $500,000. Mr. Hoffman's higher percentage increase was due to the performance of his

division, his expertise, and the heightened competition for executives in the e-commerce market. Mr. Skinner received an 8.5%

increase from $530,000 to $575,000. Mr. Skinner received a higher percentage increase in his base salary based on the increase in

salaries of chief financial officers in the group of industry related companies due to the added responsibilities of chief financial

officers with respect to regulatory compliance.

60