NVIDIA 2016 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81

excess, if any, of the fair market value of the stock on the date the award is granted over any amount paid by the recipient

for the stock.

The recipient’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired from stock

awards will be the amount paid for such shares plus any ordinary income recognized either when the stock is received or

when the stock becomes vested.

Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Internal Revenue Code and the

satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income

realized by the recipient of the stock award.

Restricted Stock Unit Awards. Generally, the recipient of a restricted stock unit award structured to conform to the

requirements of Section 409A of the Internal Revenue Code or an exception to Section 409A of the Internal Revenue Code

will recognize ordinary income at the time the stock is delivered equal to the excess, if any, of the fair market value of the

shares of our common stock received over any amount paid by the recipient in exchange for the shares of our common

stock. To conform to the requirements of Section 409A of the Internal Revenue Code, the shares of our common stock

subject to a restricted stock unit award may generally only be delivered upon one of the following events: a fixed calendar

date (or dates), separation from service, death, disability or a change in control. If delivery occurs on another date, unless

the restricted stock unit award otherwise complies with or qualifies for an exception to the requirements of Section 409A

of the Internal Revenue Code, in addition to the tax treatment described above, the recipient will owe an additional 20%

federal tax and interest on any taxes owed.

The recipient’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired from a

restricted stock unit award will be the amount paid for such shares plus any ordinary income recognized when the stock is

delivered.

Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Internal Revenue Code and the

satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income

realized by the recipient of the stock award.

Stock Appreciation Rights. We may grant under the 2007 Plan stock appreciation rights separate from any other award

or in tandem with other awards under the 2007 Plan. Where the stock appreciation rights are granted with a strike price

equal to the fair market value of the underlying stock on the grant date, the recipient will recognize ordinary income equal

to the fair market value of the stock or cash received upon such exercise. Subject to the requirement of reasonableness, the

provisions of Section 162(m) of the Internal Revenue Code, and the satisfaction of a tax reporting obligation, we will

generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the stock appreciation

right.

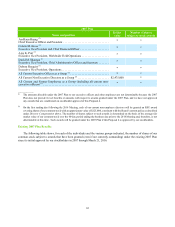

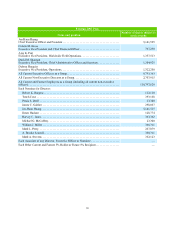

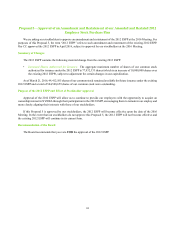

New Plan Benefits

Awards under the 2007 Plan are discretionary and are not subject to set benefits or amounts under the terms of the 2007

Plan. However, our Board’s current policy establishes the number of shares subject to initial and annual stock awards that

will be granted to our non-employee directors under the 2007 Plan. The Board’s current policy with respect to stock awards

granted to our non-employee directors is described under Director Compensation above.