NVIDIA 2016 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

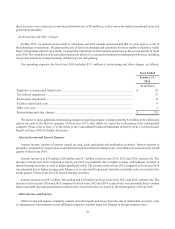

“available-for-sale,” no gains or losses are realized in our Consolidated Statements of Income due to changes in interest

rates unless such securities are sold prior to maturity or unless declines in market values are determined to be other-than-

temporary.

Other income and expense could also vary materially from expectations depending on gains or losses realized on the

sale or exchange of financial instruments; impairment charges related to debt securities as well as equity and other

investments; interest rates; and cash, cash equivalent and marketable securities balances. Volatility in the financial markets

and economic uncertainty increases the risk that the actual amounts realized in the future on our financial instruments could

differ significantly from the fair values currently assigned to them. As of January 31, 2016, our investments in government

agencies and government sponsored enterprises represented 47% of our total investment portfolio, while the financial sector

accounted for 23% of our total investment portfolio. Substantially all of our investments are with A/A3 or better rated

securities. If the fair value of our investments in these sectors was to decline by 2% - 5%, the fair values of these investments

could decline by approximately $66 million - $164 million.

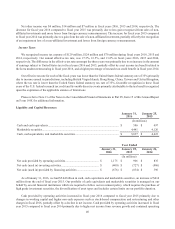

On December 2, 2013, we issued $1.50 billion of 1.00 % Convertible Senior Notes due 2018, or the Notes. Please refer

to Note 11 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K

for additional information. We carry the Notes at face value less unamortized discount on our Consolidated Balance Sheets.

Since the Notes bear interest at a fixed rate, we have no financial statement risk associated with changes in interest rates.

However, the fair value of the Notes changes primarily when the market price of our stock fluctuates.

During fiscal year 2016, we began to construct a new headquarters building in Santa Clara, California, which is currently

targeted for completion in the fourth quarter of fiscal year 2018. We are financing this construction under an off-balance

sheet, build-to-suit operating lease financing arrangement. Following construction, we will pay rent in the form of interest

that is based on a variable interest rate and is, therefore, affected by changes in market interest rates. In order to mitigate

the interest rate risk on the operating lease financing arrangement, in August 2015, we entered into an interest rate swap for

a portion of the operating lease financing arrangement, which entitles us to pay amounts based on a fixed interest rate in

exchange for receipt of amounts based on variable interest rates. Please refer to Notes 9 and 12 of the Notes to the Consolidated

Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K for additional information. If the syndicate

of banks that are participants to the operating lease financing arrangement were to fail to fund loans for any reason, we

would remain liable for payments due under the swap unless we were to settle the swap. If we were to settle the swap at a

time when interest rates have fallen (relative to the swap’s inception), the price to settle the swap could be significant.

Exchange Rate Risk

We consider our direct exposure to foreign exchange rate fluctuations to be minimal. Gains or losses from foreign

currency remeasurement are included in “Other income, net” in our Consolidated Financial Statements and to date have

not been significant. The impact of foreign currency transaction gain (loss) included in determining net income was not

significant for both fiscal year 2016 and 2015, and was a gain of $5 million for fiscal year 2014.

Sales and arrangements with third-party manufacturers provide for pricing and payment in United States dollars, and,

therefore, are not subject to exchange rate fluctuations. Increases in the value of the United States’ dollar relative to other

currencies would make our products more expensive, which could negatively impact our ability to compete. Conversely,

decreases in the value of the United States’ dollar relative to other currencies could result in our suppliers raising their prices

in order to continue doing business with us. Additionally, we have international operations and incur expenditures in

currencies other than U.S. dollars. Our operating expenses benefit from a stronger dollar and are adversely affected by a

weaker dollar.

We may enter into certain transactions such as forward contracts which are designed to reduce the future potential

impact resulting from changes in foreign currency exchange rates. There were no forward exchange contracts outstanding

as of January 31, 2016.