NVIDIA 2016 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

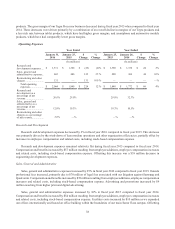

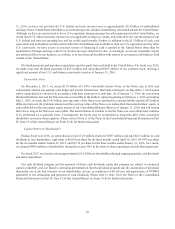

(4) Represents unrecognized tax benefits of $78 million which consists of $67 million plus the related interest and penalties

of $11 million recorded in non-current income tax payable as of January 31, 2016. We are unable to reasonably estimate

the timing of any potential tax liability or interest/penalty payments in individual years due to uncertainties in the

underlying income tax positions and the timing of the effective settlement of such tax positions.

(5) Our operating expenses for the fiscal year 2016 included $131 million of restructuring and other charges related to the

wind-down of our Icera modem operations. The $23 million represents the remaining balance of the restructuring

liability as of January 31, 2016.

Off-Balance Sheet Arrangements

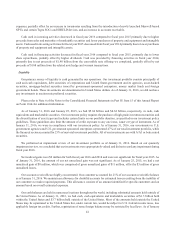

During fiscal year 2016, we began to construct a new headquarters building in Santa Clara, California, which is currently

targeted for completion in the fourth quarter of fiscal year 2018. We are financing this construction under an off-balance

sheet, build-to-suit operating lease arrangement. The banks have committed to fund up to $380 million of costs relating to

construction. Once construction is complete, the lease balance will remain static at the completed cost for the remaining

duration of the lease term. During construction, accrued interest will be capitalized into the lease balance. Following

construction, we will pay rent in the form of interest. The lease has an initial 7.5 year term expiring on December 19, 2022,

consisting of an approximately 2.5 year construction period followed by a 5 year lease term. We have the option to renew

this lease for up to three additional 5 year periods, subject to approval by the banks. During the term of the lease, we may

elect to purchase the headquarters building for the amount of the banks’ investment in the building and any accrued but

unpaid rent. At the end of the lease term, we may elect to buy the building for the outstanding balance on the maturity date

or arrange for the cash sale of the building to an unaffiliated third party. The aggregate guarantee made by us under the lease

is no more than 87.5% of the costs incurred in connection with the construction of the building. Please refer to Note 12 of

the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K for further

discussion regarding our operating lease financing arrangement.

During fiscal years 2015 and 2014, we had no material off-balance sheet arrangements as defined in Regulation S-K

303(a)(4)(ii).

Adoption of New and Recently Issued Accounting Pronouncements

Please see Note 1 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on

Form 10-K for a discussion of adoption of new and recently issued accounting pronouncements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

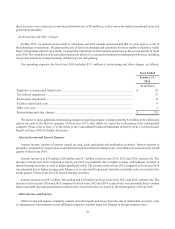

Investment and Interest Rate Risk

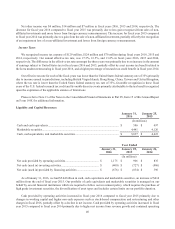

As of January 31, 2016 and January 25, 2015, we had $5.04 billion and $4.62 billion, respectively, in cash, cash

equivalents and marketable securities. As of January 31, 2016, we did not have any investments in auction-rate preferred

securities.

As of January 31, 2016, we performed a sensitivity analysis on our floating and fixed rate financial investments.

According to our analysis, parallel shifts in the yield curve of both plus or minus 0.5% would result in changes in fair values

for these investments of $28 million.

Investments in both fixed and floating rate interest earning instruments carry a degree of interest rate risk. Fixed rate

debt securities may have their market value adversely impacted due to a rise in interest rates, while floating rate securities

may produce less income than expected if interest rates fall. Due in part to these factors, our future investment income may

fall short of expectations due to changes in interest rates or if the decline in fair value of our publicly traded debt or equity

investments is judged to be other-than-temporary. We may suffer losses in principal if we are forced to sell securities that

decline in market value due to changes in interest rates. However, because any debt securities we hold are classified as