NVIDIA 2016 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

85

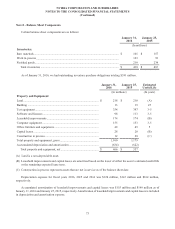

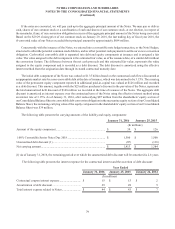

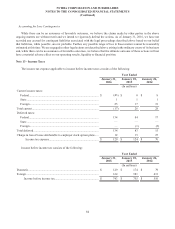

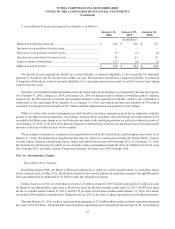

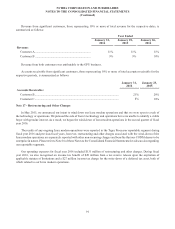

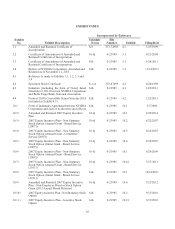

The income tax expense differs from the amount computed by applying the federal statutory income tax rate of 35%

to income before income taxes as follows:

Year Ended

January 31,

2016

January 25,

2015

January 26,

2014

(In millions)

Tax expense computed at federal statutory rate.................................... $ 260 $ 264 $ 178

State income taxes, net of federal tax effect ......................................... 112

Foreign tax rate differential .................................................................. (95)(120)(94)

U.S. federal R&D tax credit ................................................................. (38)(34)(30)

Stock-based compensation.................................................................... 1349

Tax expense related to intercompany transaction................................. 10 10 10

Restructuring and expiration of statute of limitations .......................... (21)— —

Other ..................................................................................................... (1)(1)(5)

Income tax expense................................................................... $ 129 $ 124 $ 70

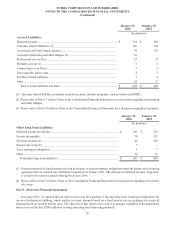

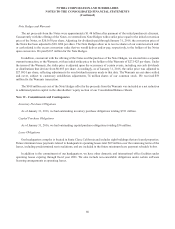

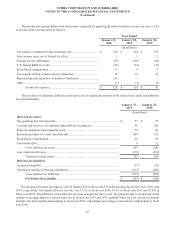

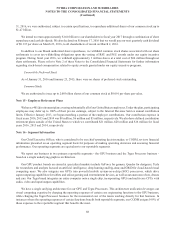

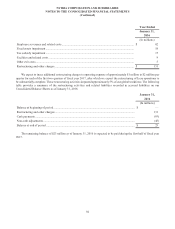

The tax effect of temporary differences that gives rise to significant portions of the deferred tax assets and liabilities

are presented below:

January 31,

2016

January 25,

2015

(In millions)

Deferred tax assets:

Net operating loss carryforwards ..................................................................................... $57$72

Accruals and reserves, not currently deductible for tax purposes.................................... 58 109

Property, equipment and intangible assets ....................................................................... 50 46

Research and other tax credit carryforwards.................................................................... 404 351

Stock-based compensation ............................................................................................... 29 30

Convertible debt ............................................................................................................... 912

Gross deferred tax assets ...................................................................................... 607 620

Less valuation allowance ................................................................................................. (272)(261)

Total deferred tax assets ....................................................................................... 335 359

Deferred tax liabilities:

Acquired intangibles ........................................................................................................ (17)(25)

Unremitted earnings of foreign subsidiaries .................................................................... (615)(500)

Gross deferred tax liabilities ................................................................................ (632)(525)

Net deferred tax liability.................................................................................... $(297)$ (166)

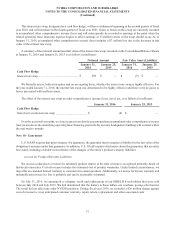

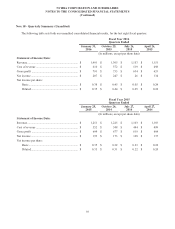

We recognized income tax expense of $129 million, $124 million and $70 million during fiscal years 2016, 2015, and

2014, respectively. Our annual effective tax rate, was 17.3% in fiscal year 2016, 16.5% in fiscal year 2015 and 13.8% in

fiscal year 2014. The difference in the effective tax rates amongst the three years was primarily due to an increase in the

amount of earnings subject to United States tax in fiscal years 2016 and 2015, partially offset by a net income tax benefit

related to the Icera modem restructuring in fiscal year 2016, and a higher percentage of research tax credit benefit in fiscal

year 2014.