NVIDIA 2016 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

87

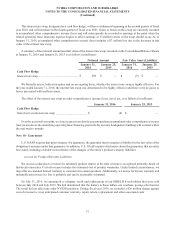

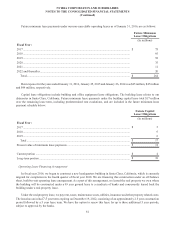

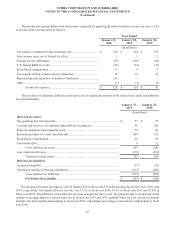

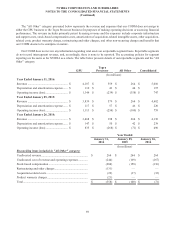

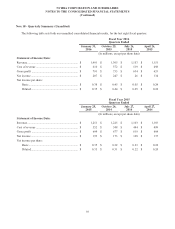

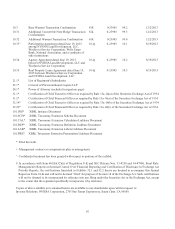

A reconciliation of gross unrecognized tax benefits is as follows:

January 31,

2016

January 25,

2015

January 26,

2014

(In millions)

Balance at beginning of period ............................................................. $ 254 $ 238 $ 221

Increases in tax positions for prior years .............................................. ———

Decreases in tax positions for prior years............................................. (1)(1)(1)

Increases in tax positions for current year ............................................ 28 23 23

Lapse in statute of limitations............................................................... (51)(6)(5)

Balance at end of period ....................................................................... $ 230 $ 254 $ 238

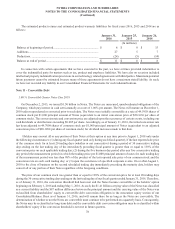

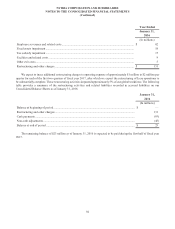

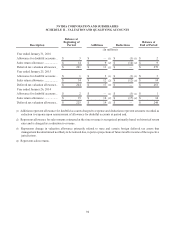

We classify an unrecognized tax benefit as a current liability, or amount refundable, to the extent that we anticipate

payment or receipt of cash for income taxes within one year. The amount is classified as a long-term liability, or reduction

of long-term deferred tax assets or amount refundable, if we anticipate payment or receipt of cash for income taxes during

a period beyond a year.

Our policy is to include interest and penalties related to unrecognized tax benefits as a component of income tax expense.

As of January 31, 2016, January 25, 2015, and January 26, 2014, we had accrued $11 million, $14 million, and $13 million,

respectively, for the payment of interest and penalties related to unrecognized tax benefits, which is not included as a

component of our unrecognized tax benefits. As of January 31, 2016, non-current income taxes payable of $78 million

consisted of unrecognized tax benefits of $67 million and the related interest and penalties of $11 million.

While we believe that we have adequately provided for all tax positions, amounts asserted by tax authorities could be

greater or less than our accrued position. Accordingly, our provisions on federal, state and foreign tax-related matters to be

recorded in the future may change as revised estimates are made or the underlying matters are settled or otherwise resolved.

As of January 31, 2016, we do not believe that our estimates, as otherwise provided for, on such tax positions will significantly

increase or decrease within the next twelve months.

We are subject to taxation by a number of taxing authorities both in the United States and throughout the world. As of

January 31, 2016, the material tax jurisdictions that may be subject to examination include the United States, Taiwan,

Canada, China, Germany, Hong Kong, France, Japan, and India for fiscal years 2003 through 2015. As of January 31, 2016,

the material tax jurisdictions for which we are currently under examination include the state of California for fiscal years

2011 through 2012, and India, Taiwan, France and Germany for fiscal years 2003 through 2015.

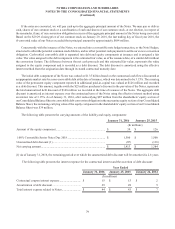

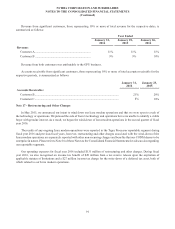

Note 14 - Shareholders’ Equity

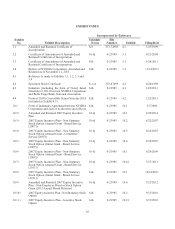

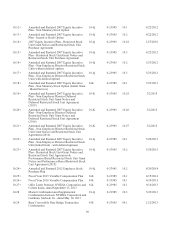

Share Repurchase Program

Beginning August 2004, our Board of Directors authorized us, subject to certain specifications, to repurchase shares

of our common stock. In May 2015, the Board extended the previously authorized repurchase program through December

2018 and authorized an additional $1.62 billion under the repurchase program.

During fiscal year 2016, we repurchased a total of 25 million shares for $587 million and paid $213 million in cash

dividends to our shareholders, equivalent to $0.085 per share for the three months ended April 26, 2015, $0.0975 per share

for the six months ended October 25, 2015, and $0.115 per share for the three months ended January 31, 2016. As a result,

we returned $800 million to shareholders during fiscal year 2016 in the form of share repurchases and dividend payments.

Through January 31, 2016, we have repurchased an aggregate of 231 million shares under our share repurchase program

for a total of $3.85 billion. All shares delivered from these repurchases have been placed into treasury stock. As of January