NVIDIA 2016 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

73

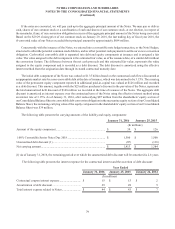

as of January 31, 2016 are temporary in nature. Currently, we have the intent and ability to hold our investments with

impairment indicators until maturity.

Net realized gains were $2 million for both fiscal year 2016 and 2014 and were not significant for fiscal year 2015. As

of January 31, 2016, net unrealized gain was not significant. As of January 25, 2015, we had a net unrealized gain of $8

million, which was comprised of gross unrealized gains of $11 million, offset by $3 million of gross unrealized losses.

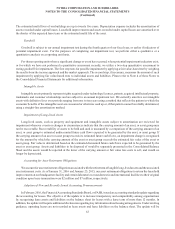

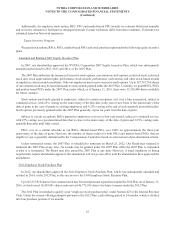

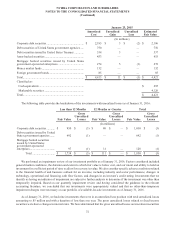

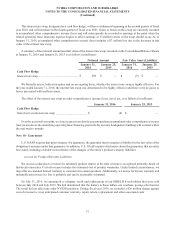

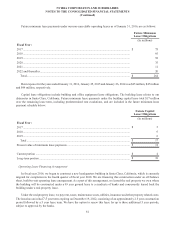

The amortized cost and estimated fair value of cash equivalents and marketable securities, which are primarily debt

instruments, are classified as available-for-sale as of January 31, 2016 and January 25, 2015 and are shown below by

contractual maturity.

January 31, 2016 January 25, 2015

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

(In millions)

Less than one year............................................................. $ 1,619 $ 1,619 $ 1,570 $ 1,570

Due in 1 - 5 years .............................................................. 3,019 3,020 2,720 2,726

Mortgage-backed securities issued by government-

sponsored enterprises not due at a single maturity date.... 34 34 123 125

Total................................................................................... $ 4,672 $ 4,673 $ 4,413 $ 4,421

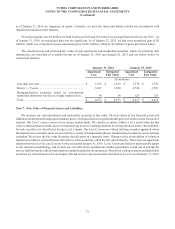

Note 7 - Fair Value of Financial Assets and Liabilities

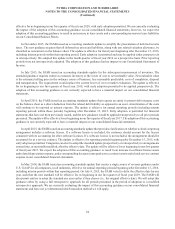

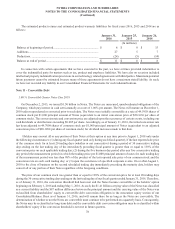

We measure our cash equivalents and marketable securities at fair value. The fair values of our financial assets and

liabilities are determined using quoted market prices of identical assets or quoted market prices of similar assets from active

markets. Our Level 1 assets consist of our money market funds. We classify securities within Level 1 assets when the fair

value is obtained from real time quotes for transactions in active exchange markets involving identical assets. Our available-

for-sale securities are classified as having Level 2 inputs. Our Level 2 assets are valued utilizing a market approach where

the market prices of similar assets are provided by a variety of independent industry standard data providers to our investment

custodian. We review the fair value hierarchy classification on a quarterly basis. Changes in the observability of valuation

inputs may result in a reclassification of levels for certain securities within the fair value hierarchy. There were no significant

transfers between Levels 1 and 2 assets for the year ended January 31, 2016. Level 3 assets are based on unobservable inputs

to the valuation methodology and include our own data about assumptions market participants would use in pricing the

asset or liability based on the best information available under the circumstances. Most of our cash equivalents and marketable

securities are valued based on Level 2 inputs. We did not have any investments classified as Level 3 as of January 31, 2016.