NVIDIA 2016 Annual Report Download - page 210

Download and view the complete annual report

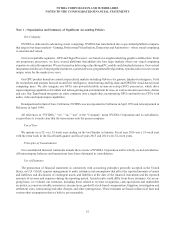

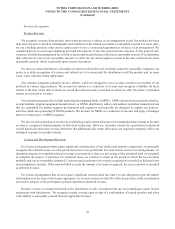

Please find page 210 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

64

effective for us beginning in our first quarter of fiscal year 2020, with early adoption permitted. We are currently evaluating

the impact of the adoption of this accounting guidance on our consolidated financial statements, however, we expect the

adoption of this accounting guidance to result in an increase in lease assets and a corresponding increase in lease liabilities

on our Consolidated Balance Sheets.

In November 2015, the FASB issued an accounting standards update to simplify the presentation of deferred income

taxes. The new guidance requires that all deferred tax assets and liabilities, along with any related valuation allowance, be

classified as noncurrent on the balance sheet. The update is effective for fiscal years beginning after December 15, 2016,

including interim periods within that reporting period. Early adoption is permitted and may be applied either prospectively

or retrospectively. We adopted this update in the fourth quarter of fiscal year 2016 on a prospective basis. Prior reporting

periods were not retrospectively adjusted. The adoption of this guidance had no impact on our Consolidated Statements of

Income.

In July 2015, the FASB issued an accounting standards update for the subsequent measurement of inventory. The

amended guidance requires entities to measure inventory at the lower of cost or net realizable value. Net realizable value

is the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal

and transportation. The requirement would replace the current lower of cost or market evaluation. The update is effective

for us beginning in our first quarter of fiscal year 2018, with early adoption permitted to be applied prospectively. The

adoption of this accounting guidance is not currently expected to have a material impact on our consolidated financial

statements.

In April 2015, the FASB issued an accounting standards update that requires an entity to present debt issuance costs

on the balance sheet as a direct deduction from the related debt liability as opposed to an asset. Amortization of the costs

will continue to be reported as interest expense. The update is effective for annual reporting periods (including interim

reporting periods within those periods) beginning after December 15, 2015. Early adoption is permitted for financial

statements that have not been previously issued, and the new guidance would be applied retrospectively to all prior periods

presented. The update will be effective for us beginning in our first quarter of fiscal year 2017. The adoption of this accounting

guidance is not currently expected to have a material impact on our consolidated financial statements.

In April 2015, the FASB issued an accounting standards update that provides clarification on whether a cloud computing

arrangement includes a software license. If a software license is included, the customer should account for the license

consistent with its accounting for other software licenses. If a software license is not included, the arrangement should be

accounted for as a service contract. The update is effective for reporting periods beginning after December 15, 2015, with

early adoption permitted. Companies can elect to adopt the standard update prospectively or retrospectively to arrangements

entered into, or materially modified, after the effective date. The update will be effective for us beginning in our first quarter

of fiscal year 2017. We expect the adoption of this accounting guidance to result in an increase in software license assets

and related depreciation expense, and a corresponding decrease in prepaid service contract assets and related service contract

expense in our consolidated financial statements.

In May 2014, the FASB issued an accounting standards update that creates a single source of revenue guidance under

U.S. GAAP for all companies, in all industries, effective for annual reporting periods beginning after December 15, 2016,

including interim periods within that reporting period. On July 9, 2015, the FASB voted to defer the effective date by one

year, such that the new standard will be effective for us beginning in our first quarter of fiscal year 2019. The FASB will

also permit entities to adopt the standard one year earlier if they choose (i.e., the original effective date). We will adopt this

guidance either by using a full retrospective approach for all periods presented in the period of adoption or a modified

retrospective approach. We are currently evaluating the impact of this accounting guidance on our consolidated financial

statements and have not yet determined which transition method we will apply.