NVIDIA 2016 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2016 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

72

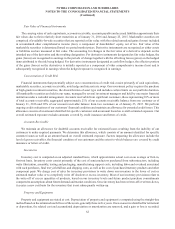

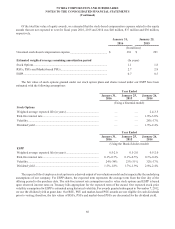

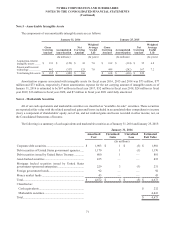

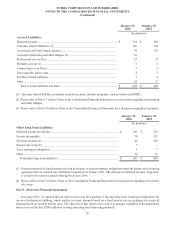

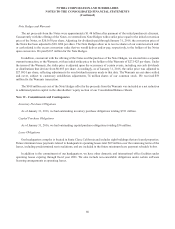

January 25, 2015

Amortized

Cost

Unrealized

Gain

Unrealized

Loss

Estimated

Fair Value

(In millions)

Corporate debt securities................................................... $ 2,185 $ 3 $ (2) $ 2,186

Debt securities of United States government agencies ..... 750 — — 750

Debt securities issued by United States Treasury ............. 534 3 — 537

Asset-backed securities ..................................................... 453 — — 453

Mortgage backed securities issued by United States

government-sponsored enterprises.................................... 274 5 (1) 278

Money market funds ......................................................... 132 — — 132

Foreign government bonds................................................ 85——85

Total................................................................................... $ 4,413 $ 11 $ (3) $ 4,421

Classified as:

Cash equivalents ............................................................. $295

Marketable securities ...................................................... 4,126

Total................................................................................... $ 4,421

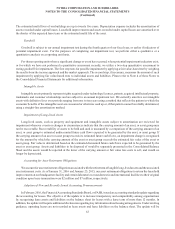

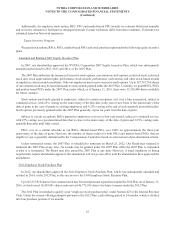

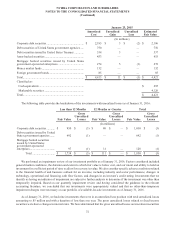

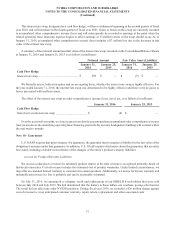

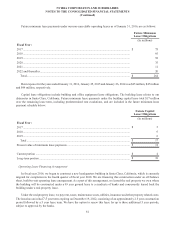

The following table provides the breakdown of the investments with unrealized losses as of January 31, 2016:

Less than 12 Months 12 Months or Greater Total

Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

(In millions)

Corporate debt securities............ $ 950 $ (3) $ 80 $ — $ 1,030 $ (3)

Debt securities issued by United

States government agencies ....... 692 (1) — — 692 (1)

Mortgage backed securities

issued by United States

government-sponsored

enterprises .................................. 97 (1) 31 — 128 (1)

Total ............................... $ 1,739 $ (5) $ 111 $ — $ 1,850 $ (5)

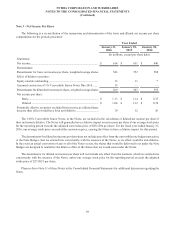

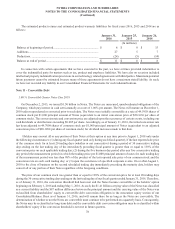

We performed an impairment review of our investment portfolio as of January 31, 2016. Factors considered included

general market conditions, the duration and extent to which fair value is below cost, and our intent and ability to hold an

investment for a sufficient period of time to allow for recovery in value. We also consider specific adverse conditions related

to the financial health of and business outlook for an investee, including industry and sector performance, changes in

technology, operational and financing cash flow factors, and changes in an investee’s credit rating. Investments that we

identify as having an indicator of impairment are subject to further analysis to determine if the investment was other than

temporarily impaired. Based on our quarterly impairment review and having considered the guidance in the relevant

accounting literature, we concluded that our investments were appropriately valued and that no other-than-temporary

impairment charges were necessary on our portfolio of available-for-sale investments as of January 31, 2016.

As of January 31, 2016, we had nine investments that were in an unrealized loss position with total unrealized losses

amounting to $5 million and with a duration of less than one year. The gross unrealized losses related to fixed income

securities were due to changes in interest rates. We have determined that the gross unrealized losses on investment securities